In global FX market, everywhere you see the only trendy voice that you could hear is that the US dollar weaker, weaker, weaker. USD only moves in one direction at the moment that is southwards. Be it against EUR, JPY or CNY: USD is easing on a broad basis. Against EUR it is slowly approaching the 1.20 mark. It is becoming gradually clear that the greenback is also suffering not only as a result of Fed’s recent guidance but also the President Trump’s weak government. It is unfair to give all credits on Fed’s kitty. Central banks’ policy divergence is the other predominant aspect to be considered.

The broad dollar ground lower in the recent times to make a fresh multi-month low even though the Fed indicated that balance sheet normalization is on the cards for September. The red flags for the currency came in on the back of a tweak in the Fed’s language on inflation was interpreted by markets as dovish and activity data beat expectations in Europe and Asia.

The US data released at the end of the week further reinforced bearish momentum for the dollar with the important quarterly employment cost index coming in below than expectations, thus indicating soft inflation pressures in the US.

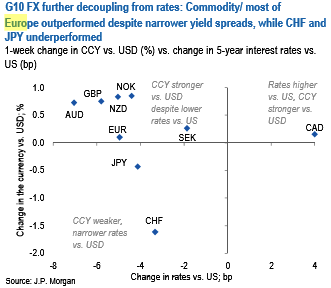

The macro theme of Europe leading outperformance remained dominant with Scandis outperforming in G10 on strong data/higher oil prices and EMEA in EM. Other remarkable market moves came from:

i) Swiss franc (EURCHF made a new high since the SNB abandoned the floor) on possible M&A flow and SNB comments that while not a departure from their previous stance, reiterated that their policy stance remains unchanged putting them in contrast with several other DM central banks where policy is evolving, and

ii) The commodity prices with oil and base metals higher across the board, giving commodity currencies a lift as well, despite narrower yield spreads (refer above chart). Against this backdrop, the portfolio has fared well in the past week.

In G10, longs in Europe (EUR, NOK) vs USD and JPY have broadly paid off while the performance of EM trades has been more mixed.

Recent FX market moves in G10 have been primarily about a divergence in central bank policy, so a strengthening in currencies where central bank policy is likely to or has already started to pivot (ECB, BoC) vs. those where central banks are likely to keep policy unchanged and stay dovish (BoJ and possibly SNB).BoC) vs those where central banks are likely to keep policy unchanged and stay dovish (BoJ and possibly SNB).

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise