NZD should weaken again on rate compression from both sides as the Fed hikes and RBNZ eases another 50bp (only 25bp is priced).

The newer theme is material deterioration in the current account deficit from -3.5% to -6% or -7% (just shy of the record -8%) on a low household saving rate and falling dairy prices.

NZD is vulnerable to this as it remains expensive, the curve prices only 35bp of the 50bp policy rate cut we expect by 1Q16, and the current account deficit is set to potentially double from 3.5% to -6% or -7%. We forecast a high single-digit return on short NZDUSD by 1Q.

Antipodean vols are likely to lift modestly (3M ATMs around +1 point) in H1 in 16. Own gamma heading into the Fed cycle and sell risk-reversals preferentially on spikes.

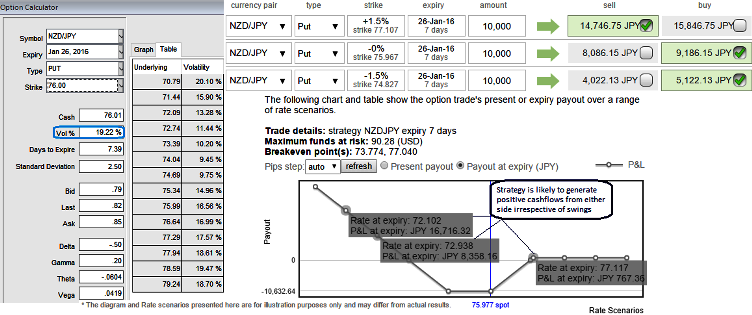

Currency Hedging Strategy: Diagonal NZD/JPY Put Ladder

Since the short put ladder is an unrestricted return with partial risk bearing strategy that is deployed because in addition to the puzzling uptrend in short term and downtrend in long-term, we think that the NZDJPY would also perceive significant volatility in the near term.

With current spot FX at 75.812 levels, the strategy takes care of long term basis hedging motives and build shorts on 1W 1.5% ITM put option (shorter expiry that should match to the upswings in near term) and we are awaiting the more functionality of longs on 15D ATM -0.50 delta put option and one more long position on 1M (-1.5%) OTM -0.39 delta put option.

Caution: Please be noted that the exxpiries shownn in the diagram are meant for demonstration purpose only, use expiries accurately as stated above in the strategy.

The strategy would derive an unlimited yield with limited risk in this options trading that is employed as we think that the underlying pair will experience significant volatility in the near term (see diagram for IVs of 1W ATM put contract, almost 19.25%).

Alternatively, NZDUSD puts can be cheapened by adding a continuous KO in AUDUSD, so selling AUDNZD correlations in the mid-70s.

We believe AUD will be materially better supported than NZD. -Buy a NZDUSD 4-mo 0.62 put for 1.59% USD notional (spot ref 0.6513). -Buy a NZDUSD 4-mo 0.62 put with a 0.65 KO in AUDUSD for 0.80% USD notional (AUD ref 0.7197).

FxWirePro: More vulnerability for Antipodeans in H1 2016 – deploy NZD/JPY put ladders capitalizing on short term upswings

Tuesday, January 19, 2016 5:57 AM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?