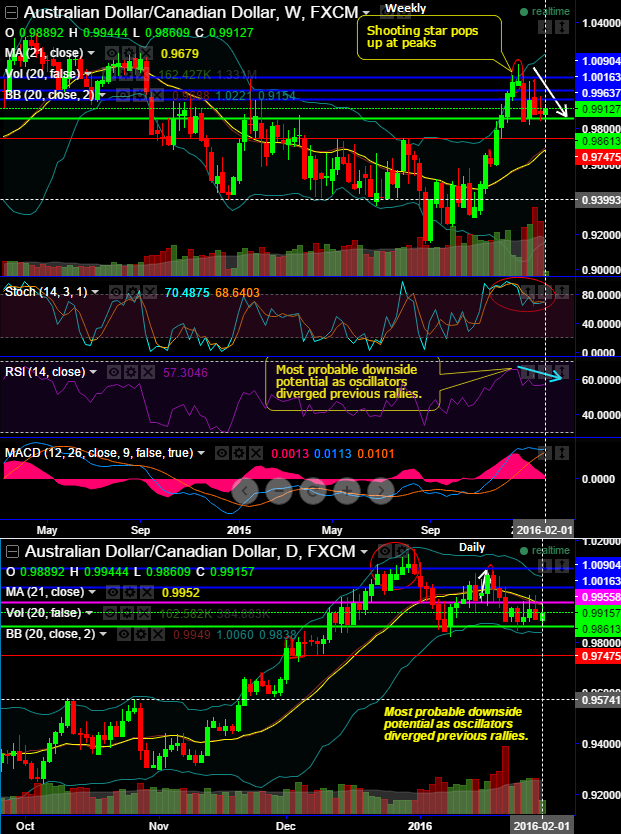

On weekly charts, AUDCAD signals selling pressures that would likely to plunge down upto 0.9452 levels but currently 0.9861 is holding stronger. Shooting star patterns occurred at peaks of 1.0074 levels and we've seen their bearish effects so far in the recent weeks, we still believe these downswings to prevail and evidence more price declines.

While, the RSI oscillator is a clear downward convergence near overbought territory with the steep declining prices.

While strong signs of selling pressure on slow stochastic curve as there is clear %D line crossover above overbought zone.

On daily charts, the current spot FX slipping below 21DMA would prolong bearish trend and bring in more slumps up to 0.9452 areas.

Massive volume build ups as the price dips began from shooting star formation which would mean that selling momentum has been intensified with these rising volumes.

Hence, on a hedging perspective, debit put spreads are advocated as the selling indications are piling up on both weekly and daily graphs. Although we foresee short term downtrend on this pair on weekly and EOD charts we like to stay in safe zone and recommend going long in 2W (1%) In-The-Money 0.71 delta puts and to reduce the cost of hedging by financing this long position, shorting 4D (0.5%) Out-Of-The-Money put option with positive theta and delta close to zero.

FxWirePro: More downside potential in AUD/CAD shooting star – more dips likely

Monday, February 1, 2016 1:28 PM UTC

Editor's Picks

- Market Data

Most Popular