The final April HICP release is set to confirm the flash at -0.2% yoy. The French unemployment rate is set to fall by one tick to 10.2% in Q2 16. The EC is expected to publish its country specific recommendation this week.

Spain and Portugal appear at risk of a step-up of the excessive deficit procedure, hence becoming the first countries for which the EC recommends a fine.

Finally, the minutes of the April ECB meeting should confirm that the ECB is focusing on the implementation of the measures announced in March and not considering any new tools.

On the flip side, AUD seems adjusting lower after RBA's surprising package in monetary policy, a 25 bps cut to keep interest rate at 1.75%. The statement's description of the AUD is little changed, saying "the exchange rate has been adjusting to the evolving economic outlook."

But for now, the RBA to stay on hold, despite its easing bias. Indeed, low inflation conditions suggest that the central bank would be more open to cutting rates if there were deterioration in economic conditions, particularly in the labour market.

However, we believe that Australia's low potential growth rate of 2.5% helps to explain the underlying strength in labour markets despite sluggish GDP growth.

Hedging Frameworks:

Considering above fundamental aspects in mind, it is advocated that the EURAUD’s uncertainties are to be mitigated through below FX option strategy,

Hereafter, any upswings should be capitalized as writing opportunity so as to reduce the hedging cost.

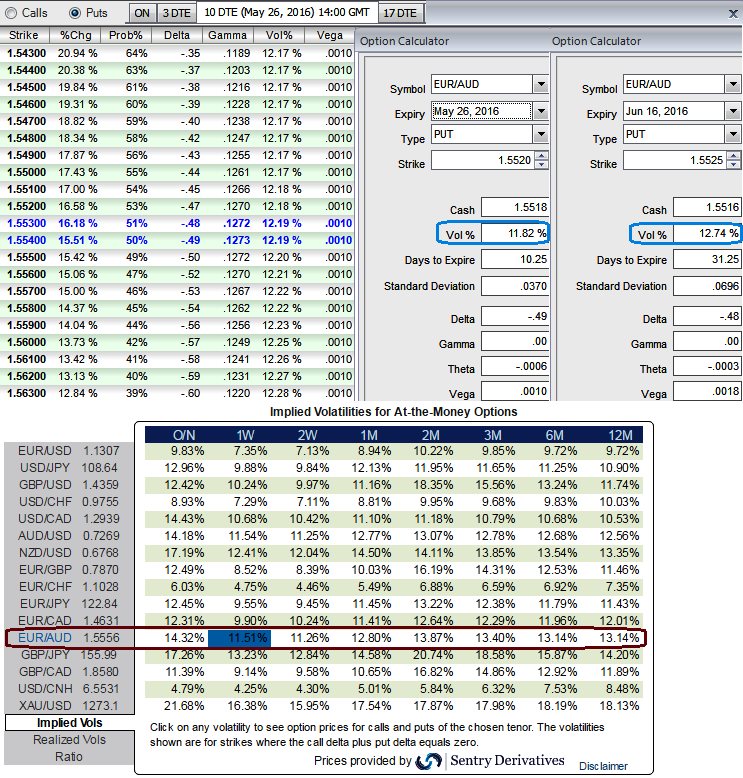

Most importantly, ATM IVs are spiking higher, volatility smiles most frequently show that traders are willing to pay higher implied volatility prices as the strike price grows aggressively out of the money.

ATM IVs of EURAUD is at 11.51% for 1w expiry and 12.80% for 1m tenors and most likely to spike euro vols in next 3 months time ahead of Brexit event risks.

So, the recommendation for now is to go long in 2W ATM -0.49 delta put, long in 1M (1%) OTM -0.39 delta put and simultaneously short 1W (1.5%) ITM put with positive theta.

As the strikes have been narrowed, the profit potential is greater, so that the ratio needed is also lower to profit on underlying movement.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022