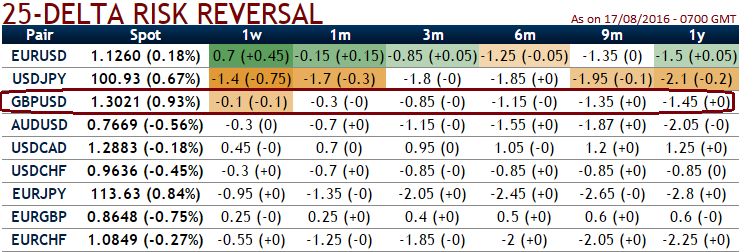

The risks to the new forecasts remain of GBP skewed to the downside in the event that foreign investors require even more of an FX risk premium to compensate for the accelerated decline in UK yields and the extended period of economic uncertainty related to the terms of the UK’s separation from the EU.

Retail: Negative impact. UK retailers in both HY and IG mostly have limited international diversity and are significantly at risk from any consumer retrenchment. Current unseasonal weather provides an unhelpful backdrop for NF retailers, whilst intense competition and falling prices are already challenging in food retail.

Food & beverage producers: Moderately negative impact. UK HY food producers are very UK focused. Hedging should postpone the currency impact on imported foods but through 2017 euro-led inflation seems likely.

Margin pressure across the food chain seem more likely with a soft consumer backdrop. In contrast, IG food producers are large, global and the impact is slightly positive (Unilever), as it is in spirits (Diageo).

Leisure: Negative impact varies on severity with very different businesses. Tough on UK gaming names where tax risk also more elevated (Ladbrokes/William Hill uncovered). Slightly less negative on tour operators (Thomas Cook) given a pan-European franchise.

Metals & Mining: Neutral impact. Little direct exposure to the UK. The stronger dollar is currently the positive, but we expect copper to underperform industrial metals on the back of this to nullify this effect.

In steel, the implications are more mixed, with higher macro uncertainties in Europe but potentially more inclination to protect the domestic markets from cheap imports.

GBP benefited from a classic dead-cat bounce when the BoE opted to defer its policy response to Brexit in July. The rally was short-lived as the BoE kept its word and delivered a comprehensive package of measures at the subsequent meeting last week.

GBP has since fallen by 3% and the index is close to setting a new post-Brexit low. This latest phase of the sell-off brings the cumulative decline in GBP to 18% since November.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX