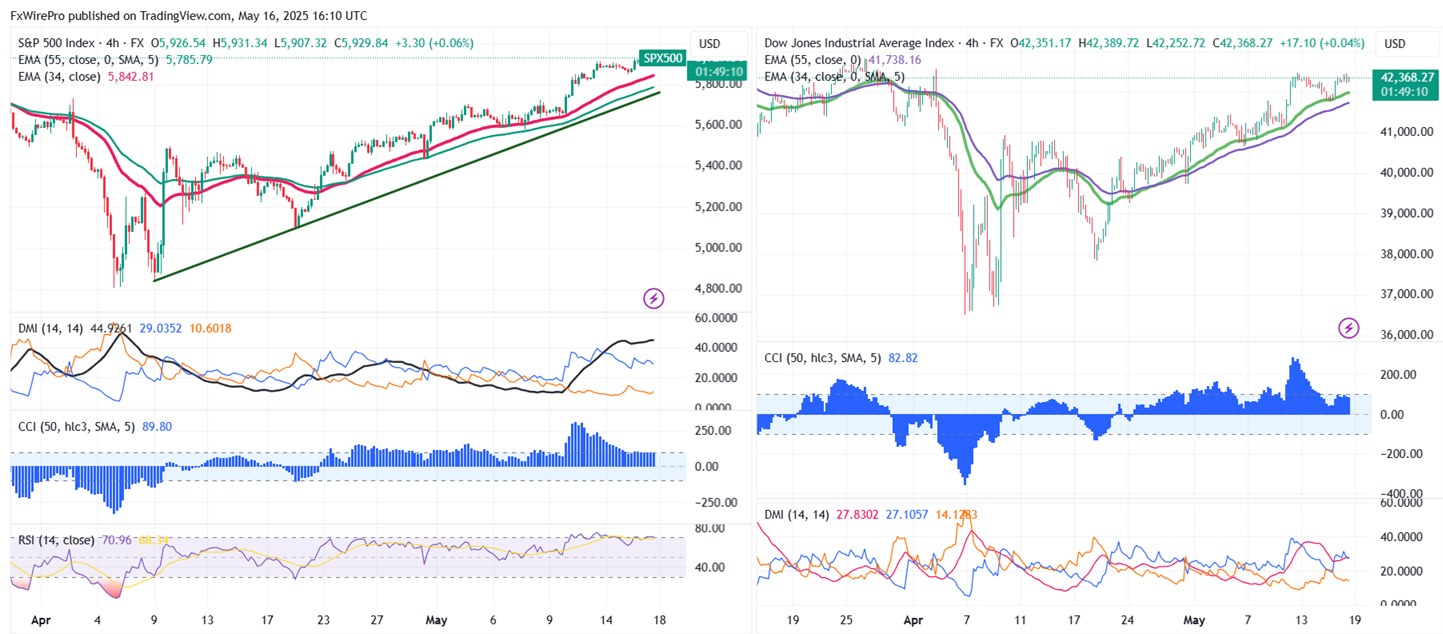

S&P 500- 5929 (0.20%)

Major resistance- 6150

Near-term resistance - 5950/6000/6064/6100.

Minor support-5840/5780/5725/5679/5600/5550/5465/5400/5330.

Trend reversal level- 4800

The pair holds above short term (34, 55 EMA) and the long term (200 EMA) in 4-hour chart.

Indicators (4- hour chart)

ADX- Bullish (4-hour chart)

RSI - 67.34 (4-hour chart)

US 30- 42321 (-0.05%)

Major resistance- 45757

Near-term resistance -42566/43000

Minor support- 41800/41500/40800/40464/40000/39700.

Trend reversal level- 36000

Indicators

ADX- Bullish (4-hour chart)

RSI - 61.94 (4-hour chart)

Russel - 2101 (0.16% )

Major resistance- 2500

Near-term resistance - 2120/2200.

Minor support- 1680

Trend reversal level- 1680

Indicators

ADX- Neutral (4-hour chart)

RSI - 66.75 (4-hour chart)