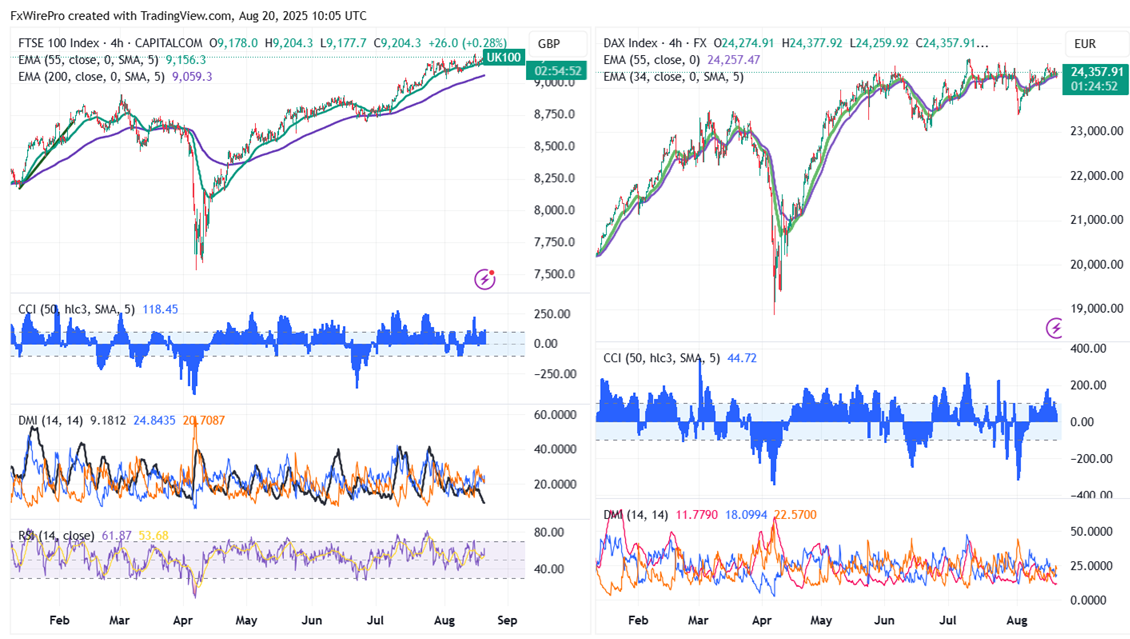

Germany DAX - 24355 (0%)

Major resistance- 24800

Near-term resistance 24445/24600/24700/24800.

Minor support - 24200/23950/23600/23000/22700/22300.

Trend reversal level- 17000

The pair holds above short-term (34 EMA, above 55 EMA) and long-term (200 EMA) in the 4-hour chart.

Indicators (4-hour chart)

ADX- Neutral (4-hour chart)

CCI (50)- Bullish

RSI - 46.40 (4-hour chart)

France CAC - 7975 (0.09%)

Major resistance- 8254

Near-term resistance - 8000/8200

Minor support- 7850/7750/7680/7520/7450/7340/7300/7250/7200.

Trend reversal level- 5600

Indicators

ADX- Bullish (4-hour chart)

CCI (50) - Bullish (4-hour chart)

RSI - 72.92 (4-hour chart)

UK FTSE - 9202 (0.22%)

Major resistance- 9290

Near-term resistance - 9210

Minor support- 9120/8990/8800/8685/8600/8500/ 8400/8265/8170/8060

Trend reversal level- 7535

Indicators

ADX- Neutral (4-hour chart)

CCI (50) - Bullish (4-hour chart)

RSI - 54.23 (4-hour chart)