The U-turn happened with staggering speed. Even during the election night some of Donald Trump’s central demands disappeared from his homepage.

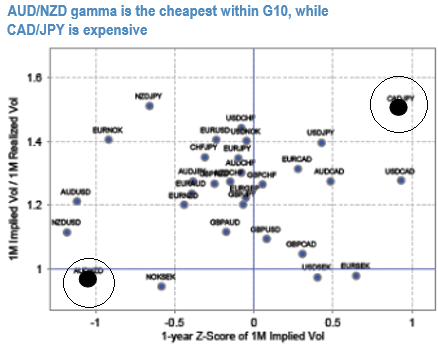

CADJPY vol: CAD is the G10 counterpart of MXN, and it is no surprise that two out of three entries in this shortlist contain CAD-crosses.

CADJPY is by far the most expensive gamma in G10 (see above chart for 1m realized vols running 6-7 % pts. under 1m ATMs), and the poster-child of a high-beta vol ripe for a 2-3 pts. lower repricing should fears of a Trump presidency prove unfounded.

CAD is only 1 sigma cheap and our EM strategists that MXN and TWD are near fair value on their models. Only JPY is an exception where both the premium appears high in spot and vol.

Given this setup and the binary nature of the outcome on Tuesday, the FX market reaction around the event appear binary as well. As a result, we keep direct exposure to this event light. Coming into this week, we were positioned for -

a) Long oil currencies (NOK vs. EUR, CAD vs. GBP) but short non-oil commodity currencies (NZD vs. EUR),

b) The central bank balance sheet constraints limiting additional easing (long CHFJPY, short EURCZK),

c) We uphold longs in USDKRW on CNY weakness.

d) More Brexit-related weakness and Fed hikes and estimates to attract shorts in GBPUSD during December and early 2017.

Longs in oil currencies would likely underperform if there is a Trump outcome as risk sentiment is likely to deteriorate in the initial reaction, as would long CHFJPY as the recent bond market sell-off and the related JPY underperformance retraces, but this would be partially offset by an outperformance in long EURNZD.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand