EURUSD short-term implied valuations remain oriented south (preference to stay top heavy), perhaps in anticipation of a slightly less confident ECB going ahead. Expect resistance towards 1.2290 and the 55-day MA (1.2339) thereafter, while the downside is expected to remain supported on the approach of 1.2200 and the 100-day MA (1.2158).

Markets continue to focus on risks of escalation in Syria and in global trade, although for now, they appear to have been contained. Over the past week, equity markets and bond yields broadly recovered, while most major currencies outperformed the US dollar. Data points to watch this week include, US retail sales, followed by building permits, FOMC members’ speeches, and unemployment claims. From Euro area perspectives, German ZEW economic sentiment, CPI are the major key focus.

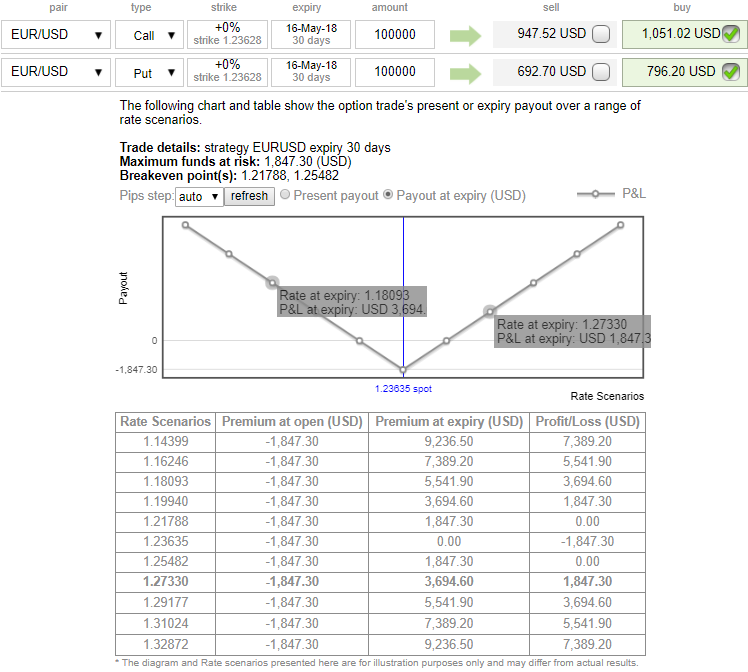

Option Strategy: Options straddle

Combination ratio: (1:1)

Rationale: Contemplating above mentioned technical environment, and ATM implied volatilities of 1m expiries are below 5.95% which is on the lower side among G7 currency segment (2nd least after EURGBP) and hence, likely bounce back.

Let’s glance at the above nutshell that indicates tepid hedging sentiments. The skews in the sensitivity tool seem well balanced on either side, the positively skewed IVs are stretched on both OTM calls and OTM puts in 3m timeframes.

In addition to that, let's glance on OTM strikes, %change in premiums and %probabilities in hitting these strikes on expiration that keeps us eyeing on shorting expensive calls with shorter expiries in conjunction with ATM straddles.

Based on this rationale, cautious hedgers can initiate the below-stated options strategy. In order to arrest both this upside and downside risks that are lingering in short-term trend, we recommend deploying options straddle strategy.

The execution:

Go long in EURUSD 1M at the money delta put, go long 1M at the money delta call and simultaneously.

Margin requirement: No.

Description: Trade the expectation of increased volatility without taking a view on any particular direction. A strategy usually utilized over significant economic data events and other political events.

Effect of Volatility: Directly proportionate to the volatility, the value of both options premiums would likely to enhance as volatility increases (good) and will decrease as volatility falls (bad).

Please be noted that the strategy likely to fetch positive cashflows regardless of the swings with more potential on the downside. Hence, one can deploy this options strategy on hedging as well as speculative grounds.

Currency Strength Index: FxWirePro's hourly EUR spot index is displaying shy above 104 levels (which is bullish). While hourly USD spot index was inching towards -12 (neutral) while articulating (at 09:08 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts