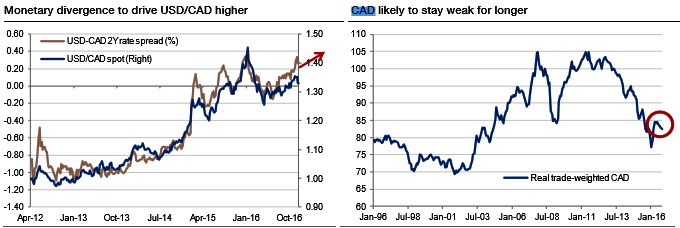

The Canadian dollar now appears cheap both from a PPP perspective and versus a time series of the real trade-weighted exchange rate (refer above graph). This has helped to support growth and is expected to last for longer, with the BoC likely to lean against any abrupt strengthening of the currency. However, we do expect further room for loonie gains against the APAC currencies, if as we expect, the Chinese slowdown deepens through 2017.

BoC firmly on hold: The lukewarm outlook suggests that the Bank of Canada will keep policy steady in the face of Fed tightening, which should nudge USDCAD gradually higher through mid-2017. The loonie remains highly correlated to oil prices, but it will likely not be able to resist broad US dollar strength (refer above graph).

Underperforming economy: The Canadian economy has bounced back in the second half of 2016 after the economic disruption caused by the Alberta wildfires earlier in the year. Economic growth, however, remains tepid overall. Business investment continues to be sluggish following the end of the energy sector boom, and export performance has not met previously upbeat expectations.

Newly announced mortgage tightening measures will also exert a negative impact on homebuilding activity. Overall inflation pressures remain limited, with the headline and core inflation rates under 2%. Low interest rates and recovering crude oil prices will likely help spur growth moderately in 2017.

Hence, add longs in a 1m2w 87.25 CADJPY AED digital put; alternatively, buy 4M sell 2M CADJPY OTM put at 80.0 strike in 1:0.761 notional.

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX