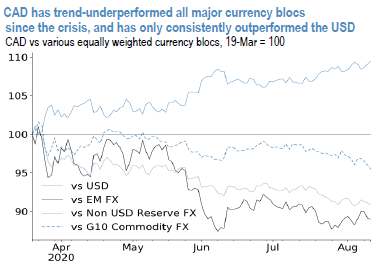

CAD outperformed a weak dollar, but underperformed most other G10 peers. USDCAD declined 2.8% since our last Key Currency Views, but this was largely reflective of a generally weak dollar. Versus most other G10 peers, CAD underperformed this past month, particularly vs NOK and SEK (both by around 3%). This has reflected a broader pattern of general underperformance against most G10 and low yielding EM currencies for most of the year (refer above charts).

We are expecting this grinding CAD underperformance to persist on account of unusually poor BoP fundamentals we have been flagging since early this year; there has been little to change our view here. Tracking this fundamental view has been difficult given significant volatility and distortions in observed flows around the COVID-19 crisis, but incoming data in the past month affirm highlighting these vulnerabilities. For example, recent trade data demonstrate how the bounce in global oil prices has not benefitted Canada’s trade account, as this price bounce was due in-part to large cuts in supply, especially from a high-cost producer like Canada.

Hence, contemplating prevailing minor upswings of USDCAD, at spot reference: 1.3103 levels (while articulating), boundary options strategy is advocated using upper strikes at 1.3167 and lower strikes at 1.3050 levels. One can achieve certain yields as long as the underlying spot FX remains between these two strikes on the expiration.

Alternatively, we recommend long hedges as BOC policy decision is scheduled for this week. This should inherently impart some upside pressure on the pair, hence, stay longs in USDCAD futures contracts of September’20 deliveries with an objective of arresting potential bullish risks in the major trend.

For CADJPY, we advocated options strips strategy to address any abrupt upswings in short-run and the major downtrend.

We’ve been firm to hold on to this strategy on both trading as well as hedging grounds, unlike spreads, combinations allow adding both calls and puts at a time in our strategy.

Buy 2 lots of 3m at the money delta put option and simultaneously, buy at the money delta call options of 1m tenor (spot reference:81.016 levels). It involves buying a number of ATM call and double the number of puts. Please be noted that the option strip is more of customized version of options combination and more bearish version of the common straddle. Courtesy: JPM

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes