In order for long/short FX vol trade discovery process, a framework based on machine learning techniques has been utilized.

SVM (support vector machine), a supervised machine learning model, was used to model the non-linear decision boundary (refer 1st chart).

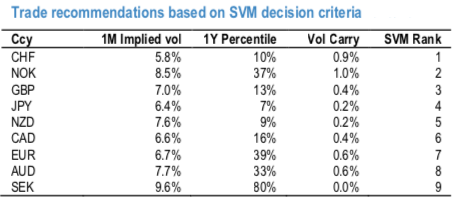

With individual G10 currency SVM models in hand we rank USD/G10 vols based on estimate of success in vol shorting (refer 2nd chart).

It exploits two cornerstones of gamma trading: implied volatility pricing (which accounts for vol mean reversion propensity) and implied-realized volatility spread (a proxy for the expected carry) in order to discover which implied vol and vol carry combinations lead to favourable vol buying/selling opportunities.

Two major factors often considered when trading volatility in FX, as well as in other asset classes, are the implied volatility level and the implied-realized volatility spread. In this report, we explore the relationship between these two variables and the profitability of FX volatility trading strategies.

In the above nutshell,we rank volatility selling candidates based on our SVM model fitting. SEK, AUD and EUR find themselves at the bottom of the G10 list.

Following the ECB meeting two weeks ago, EUR jittery spot provided support to EUR vols while the re-emergence of Italian risk premium pushed the implied vol off the recent low, even as realized vol softened amid sparse event calendar.

Despite fairly favorable EUR vol carry, the elevated implied vol justifiably weighed on EUR short vol rank.

Between the GDP surprise in July and the spillover effects from re- emergence of EUR risk, SEK realized vol bounced and caught up with SEK implied vol, sealing the rock bottom spot for SEK short vol rank.

On the opposite side of the chasm we find CHF with vol pricing near the multi-year low (a favorable characteristic for selling vol per above analysis) and at current market one of the best vol carry (alongside NOK vols).

Amid the latest leg of re-emergence of Italian political risk and uptick in investors’ interest in hedging the exposure, we find the current setup favorable for setting up long/short defensive structures.

With USDCHF stuck in a slow gear one could viably consider 1M EURUSD - USDCHF vol spread @0.8/1.1 vol indic. 1M USDCHF risk reversals are near costless as topside OTM strikes got bid recently, making us favor selling OTM USDCHF calls as a part of the vol spread instead.

Moreover, the convexity profile provides some level of protection in event of a CHF spike. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 48 levels (which is bullish), while USD is flashing at 33 (which is bullish) and CHF is at 105 (bullish), while articulating at (12:54 GMT). For more details on the index, please refer below weblink:

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed