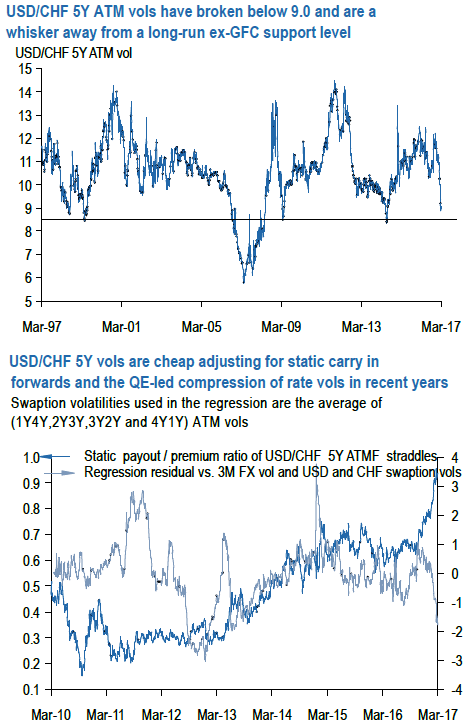

The back-end (5Y and out) USDCHF vol is beginning to approach deep value levels. While not quite through Q2’14 lows that we flagged in reference to USDJPY last week, 5Y ATMs have cratered in excess of 3 % pts and broken below 9.0 for the first time since that Great Moderation 2.0 period, and are a whisker away from a long-run ex-GFC floor (refer above chart). A few other valuation –related observations:

Adjusted for short-dated (3M) FX vol and blended (1Y4Y, 2Y3Y, 3Y2Y, 4Y1Y) USD and CHF swaptions vols, 5Y ATMs look ~1.5 pts. too low (refer above chart).

The result is robust to the inclusion/otherwise of illiquid CHF swaptions, and suggests that the decline in long-end FX vol has undershot the QE-driven compression of interest rate volatility.

Carry/vol ratios of 5Y ATMF straddles are the highest in the post-GFC era, helped by the widening US-Swiss rate gap over the past few years (refer above chart).

In fact, forward points are large enough now to almost cover the entire straddle premium, and USDCHF outranks every other G10 currency on this metric including traditional carry heavyweights such as AUD and NZD.

Carry in forwards aside, slide along the vol surface is the other significant component of overall option bleed; in this respect, the flattening of the 5Y- 1Y vol curve since last year (current +0.8 pts from 2 vols + in Q3’16) is helpful, though there is still some way to travel before hitting the pancake flat plateau of the pre-2007 years.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?