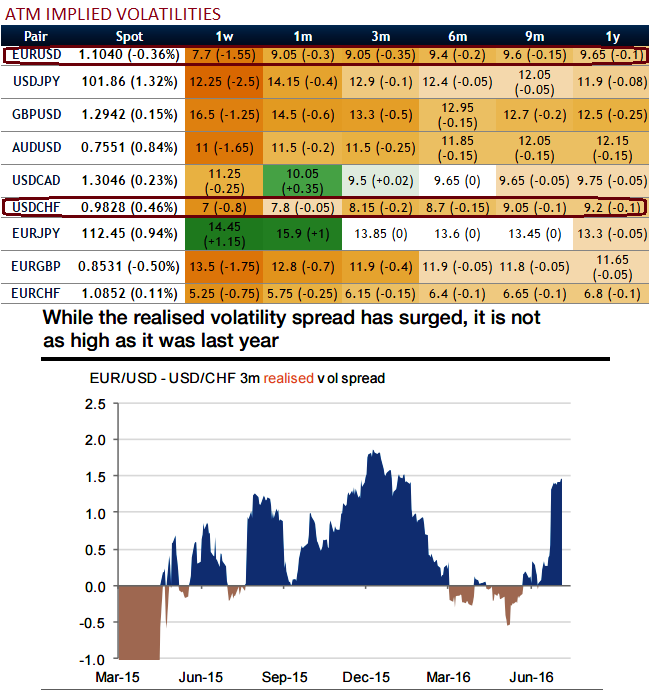

Further divergence between EUR/USD and USD/CHF volatility A spread of volatility swaps is exposed to the volatility differential between two currency pairs. Investors holding the position until the 3m expiry face unlimited losses if the realised volatility between EUR/USD and USD/CHF eventually exceeds 0.7 vols.

As we expect the vol spread to converge towards a flat level, it is advisable to go long in USD/CHF vs shorts in EUR/USD 3m volatility swaps, indicative bid: receive 0.7 vols.

However, past patterns suggest that the realised vol of the spread could exceed 0.7 vols (see above graph).

As such, we recommend unwinding the position before the expiry as soon as the net profit exceeds 0.5 vols.

Long/short of volatility swaps as a pure volatility trade, we recommend getting a pure volatility exposure via a long short of volatility swaps.

It allows for getting rid of systemic delta hedging and more generally of most of the gamma risks.

The pay-off of these instruments depends on realised volatility but their market to market (vega) is sensitive to implied volatility as well.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate