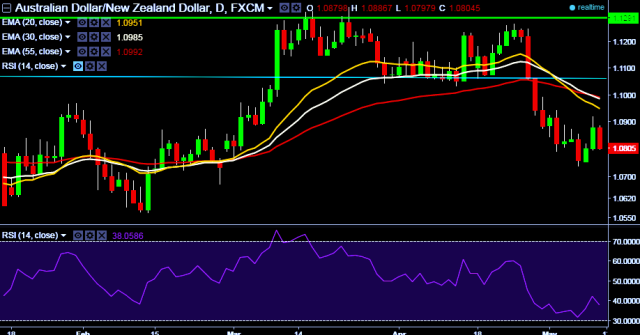

- AUD/NZD is trading around 1.0806 marks.

- Pair made intraday high at 1.0886 and low at 1.0797 marks.

- The RBNZ on Wednesday said it will consider more steps to help New Zealand's overheated property market.

- RBNZ added further LVR restrictions and measures around debt to income on radar and any new measures could be implemented nationwide.

- On the other side, The Westpac-Melbourne Institute Consumer Sentiment index jumped 8.5% in May to a January-2014 high of 103.2, after falling to a seven-month low of 95.1 in April.

- Intraday bias remains bearish for the moment

- A daily close below 1.0819 will take the parity down towards 1.0735/1.0651 marks respectively.

- On the other side, a sustained close above 1.0927 will drag the parity higher towards 1.0976/1.1062/1.1123/1.1298/1.1317 levels.

We prefer to take short position in AUD/NZD only below 1.0795, stop loss 1.0886 and target 1.0735/1.0651 marks.