Very recently, the British Foreign Secretary Boris Johnson will hopefully not take it personally that Sterling appreciated briefly yesterday in reaction to reports he might resign. We interpret the exchange rate moves in such a way that Sterling will benefit whenever the likelihood of Great Britain continuing to enjoy far reaching access to the European single market rises.

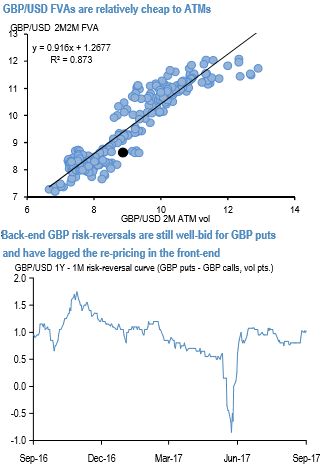

There exists a couple of option build ups that appear worth chasing after the post-Vlieghe run-up in GBP vol from a value standpoint. First, liquidity permitting, GBPUSD 2M2M FVAs offer 0.75 vols of RV edge on mids vis-à-vis 2M ATMs (refer above chart), carry flat-to-mildly positive along the vol curve and are potentially floored on P/L even if spot were to begin to consolidate if we are right that the state shift higher in implied vol is here to stay.

Second, backend (6M-1Y) GBP risk-reversals have lagged the repricing in the front-end, where skews have already flipped in favor of GBP calls in 1M and under expiries (refer above chart). While the bearish neutral risk reversals of 3m tenors indicates the bearish risks remain intact in the long term.

This is a perfectly rational market response to recent news flow, but one that should gradually adjust over time as the skew move propagates out the curve while rewarding shorts with positive smile theta along the way.

On similar skew grounds, buyers of GBP vega are best advised to install longs in the 6M-9M tenor 30D-35D strike GBP calls that represent the trough of the vol surface in most GBP pairs; directional investors sympathetic to our bearish AUD outlook might even consider 6M30-35D GBP call – AUD call option spreads as an expression of GBP bullishness while exploiting vol surface RV that makes GBP calls relatively cheap to AUD calls. We have even stated in our recent post that the cheap GBP valuations on some longer-term metrics. The additional 1.5% weakening in GBP in response to the election has made GBP the second cheapest currency globally on a REER basis

The reports of Boris Johnson standing down were due to the fact that Prime Minister Theresa May might suggest a Swiss model in her eagerly awaited Brexit speech 2.0 on Friday which would allow Great Britain to buy the right to (partial) access to the single market with contributions to the EU budget. Even though Sterling was unable to maintain the gains, yesterday’s developments illustrate that GBP investors are focused on May’s speech on Friday. Against this background today’s retail data is likely to fade into insignificance.

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data