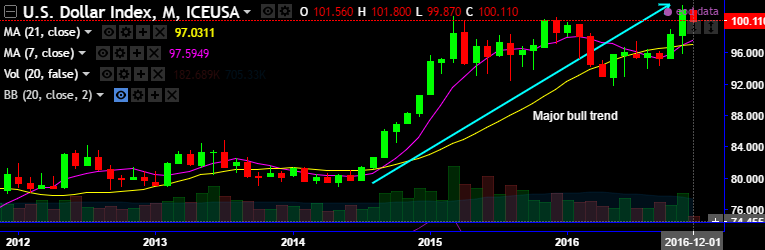

Before we begin with this write-up, this is an attempt of the analysis of the long-term performance of the dollar against the basket of major currency peers, there could be the contradicting opinions in short run but our major focus is not only on short-term swings but also on long-term trend.

Well, first and foremost, please be noted that the Dollar index (DXY) has been sliding from the last couple of months from the highs of 102.120 to the current 100.110 levels (refer monthly technical charts).

The dollar is flying high too, supported by the prospect of stronger US growth and tighter Fed policy as well as concerns about a more insular trade stance. The cyclical peak is likely to come by mid-2017, with DXY up 5% above current levels and nearly 50% up from the 2008 low.

The US economy advanced an annualized 3.2 pct on quarter in Q3, up from 1.4 pct growth in the previous period and better than a 2.9 pct expansion in the advance projection. It is the highest growth rate in two years, this is majorly driven by consumer spending, exports and investment in structures rose faster than anticipated while fixed investment fell more, according to the second estimate released by the Bureau of Economic Analysis.

Consumer prices in the United States went up 1.6 pct year-on-year in October of 2016, up from a 1.5 pct rise in September and in line with market expectations. It is the highest inflation rate since October of 2014, boosted by rising shelter and energy cost while food prices declined for the second month.

The dollar scarcity: Rise in bond yields and the USD will make it harder for non-US borrowers to roll record amounts of USD-denominated debt, causing an overshoot in the dollar rally.

We expect a low in EURUSD around parity ahead of the French Presidential elections before a gradual recovery.

The yen can weaken for longer as long as the pace of the rise in yields is measured and the BoJ maintains its 10y JGB peg at 0%. We see EURUSD to retest at 1.05, USDJPY moving back to 120, AUDUSD to hit 0.6988 again and NZDUSD at below 0.70.

You could see this in hedging arrangements, please also be noted that the nutshell showing delta risk reversals of dollar crosses evidences the upside risk sentiments of almost all pairs except USDCHF. These risk reversals are effectively useful during circumstances, such as:

If the company is willing to assume some risk in return for the chance to exchange currency upon maturity at a better rate than the current forex forward rate.

If the company wants to lock in a worse but still acceptable exchange rate just in case the exchange rate develops differently than projected by the customer.

If the company is unwilling to pay or wants to reduce the premium payment as compared to those payable in case of forex options.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022