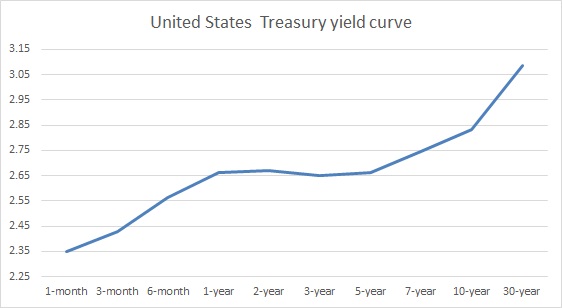

Investors are becoming increasingly worried about United States’ growth prospect going ahead, when rest of the world, especially Europe and China showing clear signs of weakness and U.S. Treasury yield curve partially inverted, which is seen as a sign of a looming recession.

It can be seen in the chart that the 2-year U.S. Treasury yield is now higher at 2.671 percent than both 3-year (2.652 percent) & 5-year (2.661 percent). Last week, 3-year yield was higher than the 5-year for the first time since the Great Recession of 2008/09. Yield curve inversion is seen as one of the most consistent and primary indications of a looming recession, which usually hits within 24-30 months of yield curve inversion, especially the 10yr-2yr spread, which is yet to turn negative.

The 10yr-2yr spread is currently at just 16 basis points (bps), which is the lowest level since 2007. If the U.S. Federal Reserve hikes interest rates by 25 bps at its December meeting, we expect the spread to further narrow and move closer to negative territory.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022