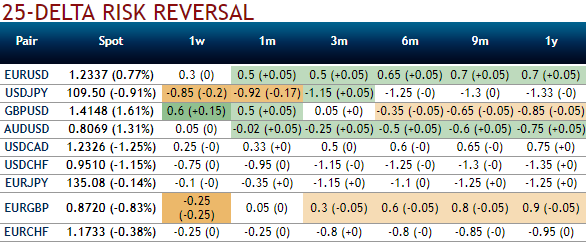

Despite mounting hedging arrangements in EURUSD for bullish sentiments ahead of ECB’s monetary policy EUR IVs remain low compared to the level of rates (refer above table).

If you glance at OTC nutshell evidencing risk reversals, the above-stated euro strengthening is substantiated. Please be noted that the RRs of 1m-1y have been indicating the hedging sentiments of bullish risks, while IV skews are also justifying the same stance.

Also, in longer tails, the EUR volatility smile remains flat compared with the rates vs vol correlation seen since 2015 and over the past week.

Despite the risk that the EURUSD correction goes further (it really hasn't gone very far yet), we're still very keen on EURJPY as a long-term long. As per the forecasts, a peak at 140 at the end of the year, and while that looks miles away it does remind that there is a lot to play for.

EURUSD risk-reversals flipped positive (bid for EUR calls) this week in sub-3M expiries in response to Euro-strength, but there are still two laggards among Euro-crosses that are bid for EUR puts and have room to play catch-up if Euro strength continues: EURJPY (3M 25D r/r -0.8mid) and EUR/gold (3M 25D r/r -0.65 mid). Spot-vol correlation performed strongly positively this week and supports a narrowing of the EUR call discount: a 2.9% rally in EURJPY was accompanied by a 0.85 %pt. jump in 3M ATM, while a2.5% rally in EUR/gold led to a +0.4 vol uptick.

Trade recommendations:

Buy EURUSD (cash) at 1.2244, stop at 1.1966.

Long EURJPY (cash) from 136.23 in the recent times as BoJ maintains status quo in its monetary policy. Marked at-0.62%.

Long a 9m 1.80 EURNZD digital call with a 3mo 1.80 window KO. Paid 17.5% on November 21. Marked at 18.3%.

Prefer a call ladder spread in GBPAUD as we expect limited spot appreciation and topside volatility, we recommend buying a call ladder of diagonal tenors. Buy 1 ITM Call of 1m tenor, simultaneously stay short in 2w 1 lot of ATM Call and Sell 1 lot of OTM Call of positive thetas (strikes 1.5260/spot/1.5610).

That structure improves the odds compared to a call spread ratio as the maximum and constant profit zone is reached over a range instead of a single spot level.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data