After a string of exciting weeks, gold continues to trade quite receptively on every twist and turn in the US economic data. To this end after softening earlier this week on more supportive retail sales and manufacturing output data for June, gold abruptly reversed course on Wednesday as US housing starts for June came in weaker-than-expected. Amidst this choppiness, gold still embeds more than a $60/oz premium vs a US real-yield based fair value which still keeps us moderately cautious on gold prices over the near-term.

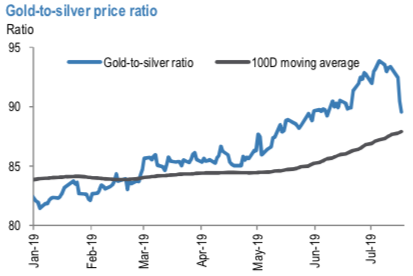

More eye-catching this week was silver which is up more than 6% in a clear catch-up move with gold. Before this week’s move, silver had been notably lagging gold over the recent broader precious metals rally. While its industrial linkages have been cited as a fundamental cause for its recent underperformance, we have continuously resisted this notion, holding a view that its historical precious-based pricing link to gold would continue to hold even if industrial demand faltered. To this end, the performance gap did close this week with the gold-to-silver price ratio falling back below 90:1, lower than where it ended May (refer 1st chart).

Over the very near-term, with gold up about 9.3% since the end of May and silver now up 10.7% over the same time frame, silver is now approaching a level that looks close to being in-line with its historical price beta to gold of between 1.3-1.5.

So while silver could undoubtedly overshoot in the near-term if gold remains in a range, it’s important to remember that this beta cuts both ways meaning that our forecasted near-term drop in gold could lead to an abrupt turnaround in silver too, now that the relative prices of the two metals are more aligned.

OTC Updates for Bullion Market: Please be noted that the positively skewed IVs of 3m XAUUSD contracts are still indicating the upside risks, bids for OTM call strikes up to 1520 signifies hedging sentiments for the higher price risks (2nd chart). One could also see a bullish risk reversal setup (3rd chart) to substantiate the above bullish hedging sentiment, risk reversal (RRs) numbers indicate overall upside risks.

The above risk reversal numbers have been known as a gauge of gold’s underlying market for bullish opportunities. Well, we know that options are predominantly meant for hedging a probable risk event in the future.

Options Strategy: Capitalizing on the minor shift in risk reversal numbers of gold in the short-run and bullish neutral risk reversals of longer tenors, we advocate longs in gold via ITM call options.

Buy 3m XAUUSD ATM -0.70 delta calls on hedging grounds. If the expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying movement, which means if the spot moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Thereby, in the money call option with a very strong delta will move in tandem with the underlying.

Alternatively, on hedging grounds, we advocated long positions in CME gold contracts. We now like to uphold the same strategy by rolling over the contracts for August’19 delivery as we could foresee more upside risks. Courtesy: JPM, Sentrix & Saxo

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data