India's gold import in last month of 2015 is valued to have exceeded 100 tonnes following sharp jump in demand for the precious metal during the month when prices slid harshly all over the world.

The higher imports could adversely impact on India's CAD again.

In terms of volumes India has been the world's top 2 consumer of the yellow metal.

If you think the prices of this precious metal are to spike up further but does not sustain at around 1,110.00 levels (that is 2-1/2 months' lows are seen where it is struggling hold the resistance at 21DMA), then cover your underlying exposures with collars strategy.

Gold CFDs rallied to two and half months' highs amid growing concerns on Chinese economic recovery which in turn keeps us worried that the Federal Reserve will hold off on hiking cycle until H2 2016. Therefore, we believe that the there is no handsome recovery for gold unless China recovers as this country has been highest importer of gold.

Hedging gold's uncertainty:

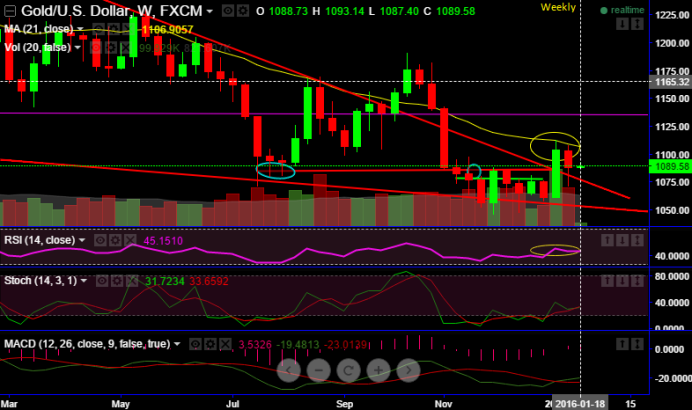

On weekly plotting of Gold CFDs rejected resistance at 21DMA (at 1113.03 & 1108.42) twice in a row.

Spot gold edged up 0.1% 1.090.87 an ounce, while U.S. gold futures for February delivery were down 90 cents to 1089.90

Futures were likely to find support at $1,063.20, the low of January 4 and resistance at $1,091.50, last Thursday's high.

Write an OTM call option + hold an ITM put option (near month Call & mid-month put). Writing OTM calls may likely to fetch certain returns since any abrupt slumps in near future may be taken care by this instrument.

This helps as a means to hedge a long position in the underlying outrights by holding longs on protective put. Thereby, any declines in this commodity would be taken care by ITM put options since the holder of the put option will have right to sell at predetermined strike price at expiry in case of American style options.

India’s gold imports volumes surge - Hedge dubious trend with collars

Monday, January 18, 2016 2:05 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings