The Bank of Japan is anticipated to maintain status quo this week after broadening the target band of 10-year bond yield to ±0.2% at the July meeting. Policymakers would adopt a more cautious view on the 2H growth outlook compared to two months ago, given the domestic typhoon/earthquake disasters, external trade tensions and intensification of emerging market volatility. While inflation may pick up in 3Q due to supply-side disruptions and oil price increases, the BOJ would pay close attention to the underlying price trend driven by wage growth and inflation expectations. August CPI, due Friday, is expected to show 1.1% YoY in the headline and 0.4% in core.

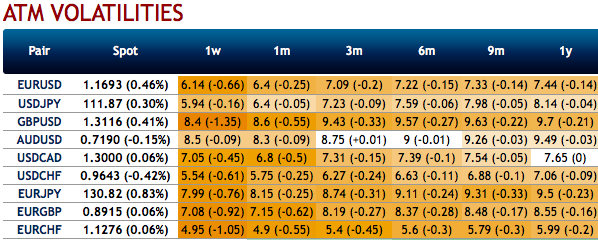

Ahead of these data events for this week, USDJPY OTC update is as follows:

The shift in USDJPY hedging sentiments can be observed if you could make out from the risk reversals numbers. Positive change in risk reversals signifies mild bullish risks in short run, whereas, on a broader perspective, the hedging activities for the bearish risks remain intact.

Most importantly, please be noted that the positively skewed IVs of 2m tenors still signal the hedgers’ interests to bid OTM put strikes upto 110.00 levels (refer above nutshell). While shrinking implied volatilities coupled with momentary shift in risk reversals would be conducive for put writers.

Accordingly, couple of days ago the debit put spreads have been advocated, wherein short leg is functioning so far as the underlying spot FX keeps spiking, we would like to uphold the same strategy but with diagonal tenors on hedging grounds.

While both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies and bidding theta shorts in short run and 2m risks reversals to optimally utilize delta longs.

At spot reference of USDJPY: 111.918 levels, buy a 2M/2w 112.168/110 put spread for 86 bps net premium indicatively (vols 7.16 vs 6.34 choice).

The maximum payout is 115bp, max payout/cost ratio is 3.2, and the put spread is 53% discounted to a standalone 2M 110.25 USD put/JPY call.

The rationale for the put spread structure is two-fold:

a) It takes advantage of the recent widening of short-dated risk reversals in favor of USD calls to reasonably stretched levels adjusted for the level of ATM vol (refer IV chart).

USDJPY 1M 25D risk-reversals currently imply a spot-vol correlation level of around -38%, which is not a historically high bar for realized spot-vol correlation to beat but is nonetheless expensive vis-à-vis recent delivered numbers (2-wk +25%, 1-mo +10%) and supportive of skew selling option structures such as put spreads; and

b) The extent of any potential yen strength from here is likely to be capped in the fundamental view, specifically after the knee-jerk decline in USDJPY spot late last week.

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at -73 levels (which is bearish), while hourly USD spot index was at -132 (bearish) while articulating at (08:09 GMT). For more details on the index, please refer below weblink:

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025