As you could see EURJPY 6m implied volatility too elevated, as it is unsupported by both 6m and 1m realized volatilities suggesting a decent risk premium to be monetized.

The variance swap recommended above expresses our views in the volatility space. Investors desiring to get a directional bullish exposure in EURJPY can take advantage of the current volatility surface confirmation by buying a topside seagull that is short both the excessive volatility and skew.

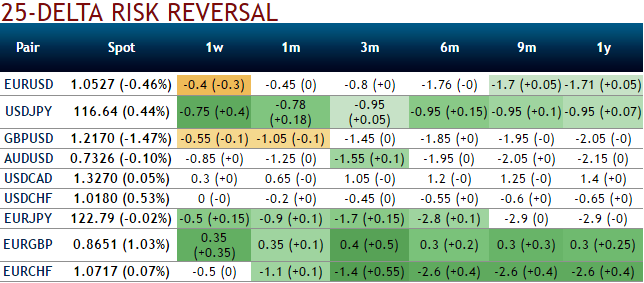

Relative value in the EURJPY volatility surface strongly suggests selling 6m and 1y low strikes, which are now valued at a premium above the shorter tenors. The RR curve strongly steepens beyond the 3m expiry, and the corresponding RR levels are trading above their median level, unlike the shorter segment (see above graph).

We recommend buying a EURJPY 6m call spread about one figure out of the money and with a strike width slightly exceeding four figures. This strategy can be fully financed by selling a 25-delta put. In terms of levels in current conditions, it amounts to buying a topside seagull with strikes 114/123.5/128.

This structure appears to be more appropriate when volatility is high but likely to likely to shrink, and the price is expected to trade with a lack of certainty on direction. Despite the limiting yields since they are spread structures rather than vanilla structures ITM longs would give magnifying impact in the payoffs.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics