Markets are focused on the US labour market prints. A weak headline jobs print, with soft wage growth will reinforce the weaker USD trend of late.

However, a weak headline jobs number with solid wage growth could signal capacity constraints. With markets pricing very little chance (10%) of a June rate hike, and just north of 50% chance of 1 hike this year there is room for upside and downside surprises.

On the flip side, RBNZ doesn’t really seem to have eased their economy by reducing 25 bps OCR in last month end or it may take time to factor in this monetary policy decision as GDP (q/q), GDT price index, manufacturing PMIs have reduced considerably and unemployment rates have increased on the other side.

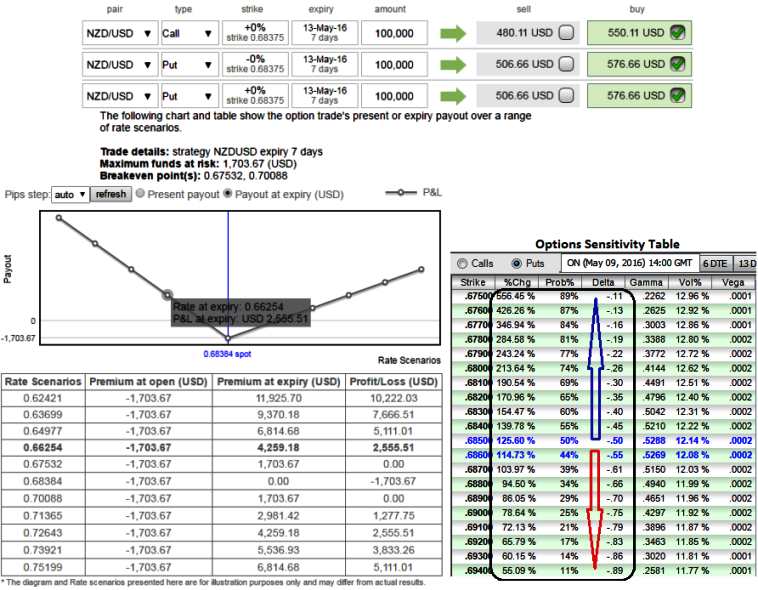

If you look at the sensitivity table also for the different rate scenarios and their probabilistic outcomes.

We've just referred 0.25% OTM put strikes and their vols, it still shows 0.47 as delta values for underlying outrights with 52% of probabilities, that means 52% chances of finishing in-the-money which is why for demonstration purpose, as shown in the figure we consider the NZDUSD ATM instruments while formulating option strips strategy at spot FX ref: 0.6837.

Scenario 1: What if NZDUSD spot keeps dipping:

The puts we deploy were not very far off from the ATM strike and cheap too (because OTM contracts).

In terms of % they will increase very fast. The call will decrease in value – but it will become out of the money.

A 200 pips movement can bring in good profits. Because when you book profits, you are already making good profits from the puts. Result: Not a big loss from the call (maximum to the extent of initial premiums paid), and great profits from the puts as result of more proportion of puts (1:2) it gives leveraging effects too in the portfolio.

Scenario 2: What if NZDUSD spot stays in range:

If the options you bought were cheaper you can hold onto expiration, else you should short after seeing no movement in near future depending upon expiries. Usually whatever movement has to come it comes in near term (3-4 days per say) after any significant news.

Then the news dies down and normal trading begins. Which indirectly means there is no point in waiting after those 3-4 trading days. Sell all options bought and book loss/profits.

Scenario 3: What if NZDUSD spot spikes up:

The call option would go ITM, it will have a good delta since we’ve chosen ATM and will move faster. The two put options bought will lose value fast, but this call option will be bringing in profits. Though since its only 1 lot, you may have to wait for some time to book profits.

Not sure here because a lot of Greeks decide the option price but if the underlying moves up 2% up in 2 days – the profit from the call bought should surpass the losses from the puts to a good extend. Remember that volatility has decreased, so 1% movement may not be enough.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed