The French political landscape has never been this unfathomable two months before the first round of a Presidential election, and less than one month before the list of candidates for the election is finalized (17-Mar).

The “Republicans” leader Fillon – a champion of austerity, is facing public outrage over misuse of public funds, and a possible indictment. Left wing parties are represented by two candidates with aggressive agendas of tax increases and social redistribution which implementations are poised to cause French debt to GDP to increase significantly. Hamon’s unconditional “universal income” has been estimated to cost a whopping EUR349bn by the Think Tank Institut Montaigne (ie ~13% of GDP), and Melenchon’s Keynesian stimulus program calls for a total EUR275bn in public spending over 5 years, which would generate a self-assessed deficit of 4.18% of GDP in 2018.

While each candidate on his own is unlikely to garner enough votes to qualify for the second round, a Left+Ecologists combined list, which many left wing politicians are calling for, could easily propel the coalition candidate to presumably face Le Pen in the second round, leading to a face-off between two anti-elitist ideologies. A scenario of a Le Pen first round score below 30%, and either Fillon or Macron as runner-up can be considered most benign, as this would lessen the risk of an unnerving momentum in favor of Le Pen.

On the other hand, a strong showing by Le Pen, or a qualification of a radical left coalition list, would most likely rattle markets. A Macron victory also has the potential to prolong political uncertainty until the Jun Parliamentary elections, since Macron’s centrist movement is a fresh one, and would struggle to gather a majority.

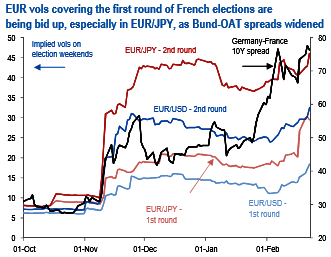

From these perspectives, it is not surprising to witness the pricing in 1st round implied vols – which had seemed complacent, edging firmly higher relative to the 2nd round (see above chart).

Efficient hedges for act 1 of French elections:

French election risk premium has taken a leg higher, especially in EURJPY vols and skews, and the spread between 1st and 2nd round risk premia has tightened.

An analysis of EURUSD option payouts shows that longer dated high delta puts funded by selling 3M 10D strangles offer best risk/reward profiles.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?