The Riksbank maintained status quo by leaving key interest rates unchanged as expected but took down the rate path by 5-7bp throughout the forecast horizon (through 2021). The minutes from Riksbank’s monetary policy meeting on 5 September were slightly more hawkish than expected. The majority of the board now sees the first-rate hike at the meeting in December or February.

Most importantly, for the very near term, they ruled out the smaller October hike by explicitly stating that the repo rate will be “raised by 0.25 percentage points either in December or February.” That a lower rate profile (even if in 25bp increments rather than in smaller amounts) was accompanied by a stronger growth forecast (2018 GDP was upgraded from 2.5% to 2.9%; 2019 from 1.9% to 2%) and only modestly lower inflation forecasts for the coming years further shines the spotlight on the ongoing dovish bias from the Riksbank and their single-minded focus on inflation.

Following the Riksbank outcome, we re-initiated tactical SEK shorts intra-week, recall we turned neutral from underweight in July as the meeting opens yet another window for using SEK as a funding currency in the interim with a rate hike not on the horizon till at least December.

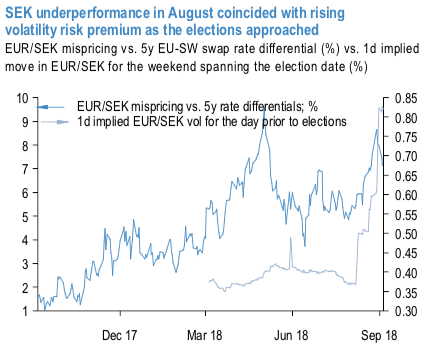

The near-term risk to SEK shorts comes from the general elections over the weekend and the CPI print next Friday, but we expect any gains from these two events to be limited. For markets, the relevant issue in the elections will be the extent to which the Swedish Democrats gain share.

A benign outcome in line with the base case could result in some SEK outperformance as the August weakening in part has coincided with an increase in the risk premium for the election date (refer above chart), but we expect the SEK bounce to be shallow. Similarly, even a firm SEK print on Friday will not necessarily provide enough fodder for SEK bulls with three more CPI prints till the December meeting. Meanwhile, the sensitivity to a softer print is likely to be larger.

Precisely, we advocate outright longs in NOKSEK and long EURSEK through options. Like SEK, we have been noting that NOK is cheap on several metrics as well and focus will now turn now turn to Norges Bank on September 20thwhere the central bank is expected to deliver its first-rate hike since 2011. The combination of cheap valuations and a more activist central bank leads us to re-initiate NOKSEK longs.

We also think that SEK is likely to stay weak vs. EUR although moves will likely be more limited given already stretched valuations.

Hence, we recommend long EURSEK through a call spread financed by a short put to also reflect the view that EURSEK will likely not head materially lower from current levels.

Trade tips:

Buy spot FX NOKSEK at 1.0830. Stop at 1.06.

Buy 2m EURSEK 10.60-10.75 call spread vs short 10.3050 put for 18.6bp. Spot reference: 10.4193. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at 51 levels (which is bullish), while hourly USD spot index was at -41 (bearish) while articulating at (11:46 GMT). For more details on the index, please refer below weblink:

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure