It is perceived as risky venture to have opened naked position on moderated volatile non directional trend. We reckon that EURJPY pair is in the same case. EUR/JPY has created a few bearish candles like dragon fly candle on daily and spinning tops on weekly patterns. Oscillators on weekly have not given clarity as to which direction the pair would head towards.

As the risk appetite varies from different investors to different traders, we've customized our formulation of strategies for such bearish reversal patterns.

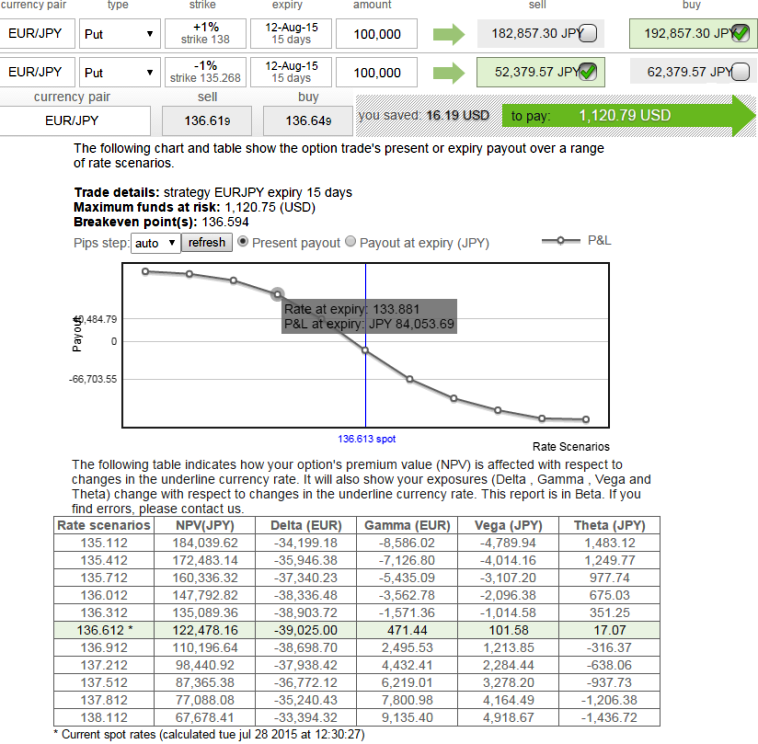

Since option gamma gives an idea of how much more or less you need to hedge in the underlying market if the market price moves by 1%. A larger Gamma means the Delta is more sensitive to a change in the underlying market price, which means a larger risk or reward.

The naked put option was highly sensitive to moves in the underlying exchange rate of EUR/JPY when gamma was at around 0.20. That is when we think it adds to the ideal risk and reward profile for both holders and writers.

Thus, on a hedging perspective, debit gamma put spreads are advocated so as to reduce the sensitivity and focus on hedging motive. Selling an Out-Of-The-Money put option is recommended to reduce the cost of hedging by financing long position in buying In-The-Money Puts.

So, buy 15D (1%) In-The-Money -0.69 delta put option with 0.18 gamma and short 15D (-1%) Out-Of-The-Money put option for net debit.

FxWirePro: Hedge puzzling EUR/JPY trend via debit gamma spreads, offers equal risk reward ratio for both writers and holders

Tuesday, July 28, 2015 7:09 AM UTC

Editor's Picks

- Market Data

Most Popular

2

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary