If you are running an open Aussie export deal and you want to make sure the certain profit or curb the losses, and keep your foreign trade active without forex hassles, you could hedge this ongoing bearish trend in AUD with an option. The effect of an option hedge is to keep the profit potential open, yet limit (hedge) any loss.

AUDUSD has dropped from the high of 0.7327 up to 0.6926 and still have more downside potential as per the OTC market sentiments, with the current levels of 0.7033 one can build hedging strategy as explained below contemplating above IVs and risk reversal computations.

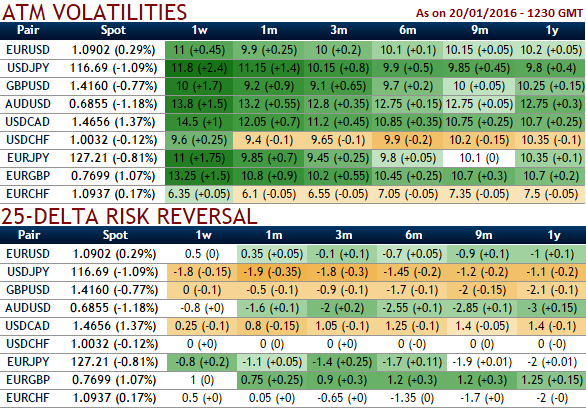

From the IV & delta risk reversal table, it is understood that AUD/USD is the pair to perceive highest IVs with most expensive puts for hedging downside risks.

25- Delta risk reversal points out the premiums of AUDUSD puts and calls on the most liquid OTM contracts due the difference vols, which in turn divulge the relative costliness of the downside protection for the underlying spot FX, so we can anticipate next underlying market downward direction with help of these negative numbers.

Hedging strategy: AUDUSD Put Ratio Back Spread

Options are generally used by private investors and businesses to hedge open or future deals. The latter is useful for companies who have overseas invoices to pay or profits to receive in a foreign currency.

We now capitalize upon higher IVS and any upswings in abrupt can be utilized by employing 2 lots of 1.5% ITM shorts in puts with shorter expiries.

1We stated to maintain the same strategy for hedgers by using these small bounces from then to help our ITM shorts, this would have certainly ensured returns in the form of premiums.

Having said that, stay firm with any existing longs on at the money -0.50 delta puts as it would begin functioning effectively from recent past. Add one more long on 1% out of the money put in order to give leveraging effects to the portfolio with lesser cost of trade since we prefer OTM instrument.

Hence, as shown in the diagram the strategy is constructed in the ratio of 3:2 for net credit with net delta at -0.50.

FxWirePro: Hedge open Aussie export payable exposure via AUD/USD PRBS

Thursday, January 21, 2016 7:09 AM UTC

Editor's Picks

- Market Data

Most Popular