On the verge of US crude inventory level checks, WTI crude futures (CL1!) today has continued yesterday's dips from $39.39 to the current $38.30 levels, down about 2.76% ahead of tomorrow's US inventory checks, while analysts have forecasted another rise to record levels for US crude accumulation in storage.

The EIA's crude oil inventories weighs the change in the number of barrels of commercial crude oil held by US firms on a weekly basis. The level of inventories will have the impact on price of petroleum products, Energy Information Administration is expected to publish its report tomorrow at around 1430 GMT. Analysts have forecasted it to be at 2.4M barrels.

Technically, The recent rallies have tested resistance at 41.84 levels which is at upper Bollinger bands, "Shooting star" has appeared at peaks of 39.54 to signal some weakness as leading oscillators diverge previous rallies, overall we see more selling pressures in this commodity at current stage.

Contemplating prevailing downtrend of WTI crude, construct strategy as shown below,

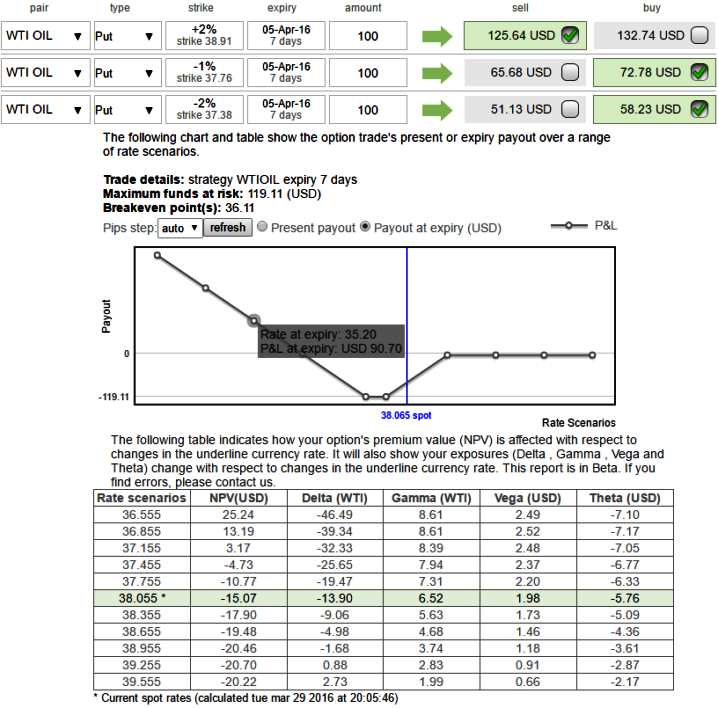

Spot WTI oil is currently trading at around $38.08, the hedger who is bearish on this commodity executes 2:1 put back-spread by initiating following trades.

Let’s just suppose hypothetical scenarios contemplating prevailing major downtrend of WTI crude. Calling for 36.21 or below levels, and shorting a near month 4D (2%) In The Money put for $125 and go long in 2 lots of the same near month contracts 1W Out Of The Money (-1% & -2% strikes of each contract) delta puts for around $130. So thereby the net debit would be reduced to enter the strategy and any potential downswings would be taken care by 2 lots of puts.

We can see the gamma difference at current spot reference, for dip in the underlying price of the commodity which means the rate of change of the Delta with respect to the movement of the rate in the underlying market. But it is even better if the dips occurs after 4 days as we have a short position in the strategy.

In the Sensitivity table, Gamma shows how much the Delta will change if the underlying rate moves by 1%.

A smaller Gamma means the Delta is less likely to change as the underlying market moves.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary