The Mexican central bank will likely leave its key rate unchanged at 7% once again, the meeting is unlikely to provide any surprises and should, therefore, be a non-event for the peso.

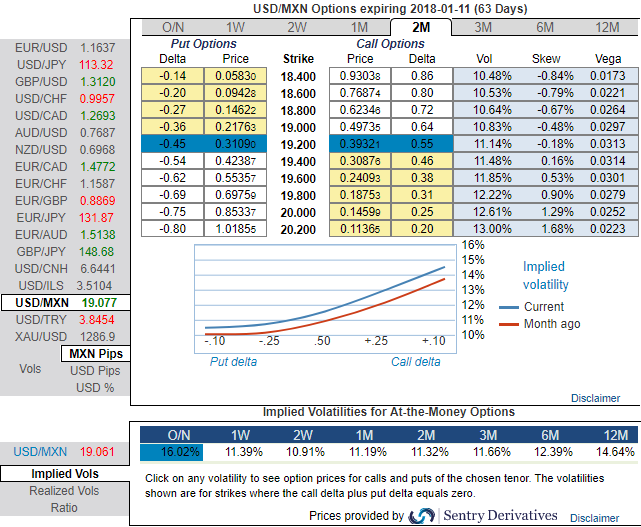

Please be noted that the current IVs of USDMXN is blowing out of the proportion, over 16% IVs are likely to collapse 11.5% in next 2w, 1m, and 2m tenors, and this has been a good news for the option writers.

However, positively skewed IVs of 2m tenors still indicates bullish risks, the telling statistic from the graphic is that that the static carry of delta hedged vega-neutral 2M skews is a very substantial 2.5 vol pt., near the upper-end of its 2-yr range.

However, if you have to observe the short-term technical trend of this pair, bearish sentiments have been mounting and slumps are most likely to test next strong supports at 18.90 levels.

Thus, the foreign traders and the investors may become a little more nervous and take a cautious approach towards MXN engagements.

The peso has come a long way from its Trump lows and screens overbought and overvalued at current levels, leading our LatAm team to turn underweight recently.

While the pair may head towards any directions with more potential on the downside in near term. According to this price behavior, we advocate options strategy as shown below that is likely optimized hedging motive.

Strategy: 3-Way Options straddle versus OTM call

Spread ratio: (Long 1: Long 1: Short 1)

How to execute: At spot reference: 1.6682, initiate long in GBPCAD 2M at the money +0.51 delta call, go long 2M at the money -0.49 delta put and simultaneously, short 2w (1%) out of the money call with positive theta. The short leg with narrowed expiry likely to reduce total hedging cost.

The standout feature of the USDMXN vol surface to us is the cheapness of risk-reversals, both vis-à-vis ATM vols and particularly relative to the amount of carry in forwards that allows for carry efficient expressions of bearish directional views or tail risk hedges.

Risks: Overall EM risk sentiment, higher UST rates or stubborn inflation could lead to the heavy long position being unwound along with debt portfolio outflows. An unfavorable NAFTA outcome is certain to structurally impair the currency.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal