3-way options straddle seems to be the most suitable strategy for EURGBP contemplating some geopolitical aspects.

The rationale: Well, let’s just quickly glance at OTC outlook before looking at the options strategies.

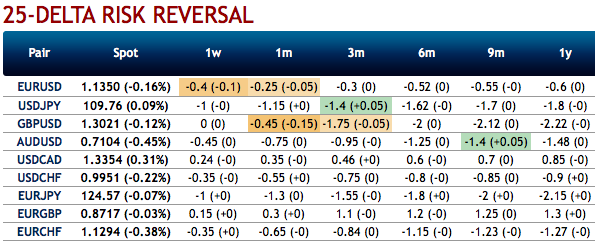

Negative bids in the shorter tenors have been observed to the bearish risk reversal atmosphere in the OTC markets, this is interpreted as the hedgers are keen on bearish risks in the short-run, whereas the long-term bullish outlook remains intact.

While positively skewed IVs of EURGBP have been stretched out on either side. This is interpreted as the hedgers' bid for both OTM calls and OTM put options.

Geopolitical surface considering the UK Parliamentary developments from the last week’s “meaningful” vote will continue to dominate the domestic focus.

Sterling was able to appreciate significantly again last night after the news emerged that the Northern Irish Democratic Unionist Party (DUP), the British government’s unofficial coalition partner, would support Theresa May’s withdrawal agreement after all next week. That was the headline. However, whoever takes a closer look at the article it refers to will quickly work out that the Sterling optimism is completely misguided. The actual statement is that the DUP will only support the agreement if May is able to agree on a time limit for the Irish backstop with the EU – something the EU has already rejected.

What is much more interesting is that there are increasing concerns as to how the EU would deal with the question of the Irish border in case of a no-deal Brexit, i.e. a disorderly British exit from the EU. If that were to happen there would be a risk of a “hard” border between the Republic and Northern Ireland – exactly what the EU is trying to prevent with the backstop. Both sides, the EU and above all Ireland and the UK have thus a strong interest in reaching an agreement. However, that is only likely to be possible if one of the parties involved is willing to abandon its “red lines”. Until that emerges the risk of a no-deal Brexit remains in place, leaving the risk of Sterling setbacks high.

It remains more expensive to hedge against strong GBP depreciation, which means that an orderly Brexit in whatever shape is still seen as being more likely. However, the risk of things going wrong is high and as a result, we regard any GBP appreciation with much scepticism.

Even if you see any fresh positive bids in risk reversals to the existing bearish setup, it should not be perceived as the bearish scenario changer. Instead, below options strategy could be deployed amid such topsy-turvy outlook.

Options strategy: Keeping above seesaw geopolitical and hedging sentiments under consideration, 3-way straddles versus ITM calls are advocated, the strategy comprises of at the money +0.51 delta call and at the money -0.49 delta put options of 2m tenors, simultaneously, short ITM call of 2w tenors. The strategy could be executed at net debit but with a reduced trading cost.

Hence, on hedging as well as trading grounds, initiate above positions with a view of arresting potential FX risks on either side but slightly favoring short-term bearish risks. Courtesy: Sentrix and Saxo

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -80 levels (which is bearish), while hourly GBP spot index was at 107 (highly bullish) while articulating (at 10:53 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges