A reassessment of BoC’s policy path will likely take time, and only after a second hike (expected October) is delivered, fully unwinding the 50bp of emergency cuts delivered in 2015 (hikes whose motivation seems more conditioned on growth rather than inflation).

Beyond inflation undershoot risks, further out the BoC policy outlook faces risks of feedback from rising mortgage rates resulting in a material slowdown in residential investment, especially given that residential real estate investment alone has contributed 16% of top line GDP growth over the last 6 quarters (and 28% last quarter).

Technically, on weekly chart plotting of EURCAD, the price behavior has been popping up various bearish patterns, the current price is tumbling through sloping channel. In addition to that, the triple top pattern has also occurred which is again a bearish pattern with peak 1 has rejected at 1.5226, peak 2 at 1.5074 and peak 3 at 1.5019 levels.

OTC outlook and Options Strategy:

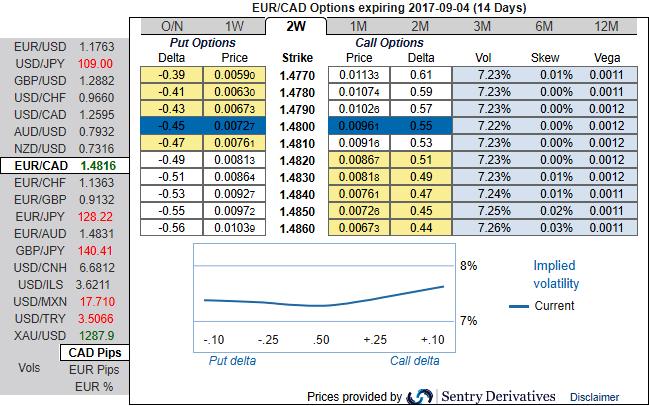

Please be noted that from spot rates, the 2w IVs skews have been neutral, while indicating upside risks evidencing positive skewness for OTM call strikes for 2m tenors. While the powerful beta-forces of Euro strength and dollar weakness continued to leave their imprint on FX vol surfaces for another week.

These positively skewed IVs of 2m tenors signify the hedgers’ tendency for bullish risks as they bid for OTM call strikes and IVs are at around 8%.

You couldn’t see any drastic spike upto next 2w tenors.

At spot ref: 1.4805 (while articulating) we advocate below FX derivatives strategy as we favor optionality to the directional trades. For the bullish streaks that we are inclined while not disregarding to position a partial retracement of the down move in near terms through call ratio back spreads (CRBS) with narrowed expiries, as calling the bottom is difficult and adding directional spot exposure is risky at the moment.

Alternatively, using ongoing dips writing any overpriced OTM calls is a wise idea on hedging grounds. Thus, you decide to initiate a diagonal call ratio back spread (CRBS) at net debit.

Execute strategy this way, to arrest both short-term dips and long-term bullish risks, initiate shorts in 2W (1%) out the money call with positive theta, simultaneously, buy 2 lots of 2M (1%) in the money 0.67 delta call option. Establish this option strategy if you expect that EURCAD would expect vigorous spikes during next 2 months tenor amid minor hic-ups in short run but spikes certainly not beyond your upper strikes.

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist