Switzerland has postede good set of trade balance numbers today, it is increased from previous 2.86B to the current 3.05B to beat the forecasts at 2.51B. The country exported 141.5 tons of gold in September, which is just shy of 19% less than in the previous month, as data from the customs authorities show.

There were also some more striking changes: exports to India for instance plunged by two thirds to just 23 tons, whereas exports to China climbed by 28% to a six-month high of 21.7 tons.

Swiss National Bank leaves monetary policy unchanged, the SNB is leaving the target range for the three-month Libor unchanged at between -1.25% and - 0.25%. The interest rate on sight deposits with the SNB remains at - 0.75%.

Technical Roundup:

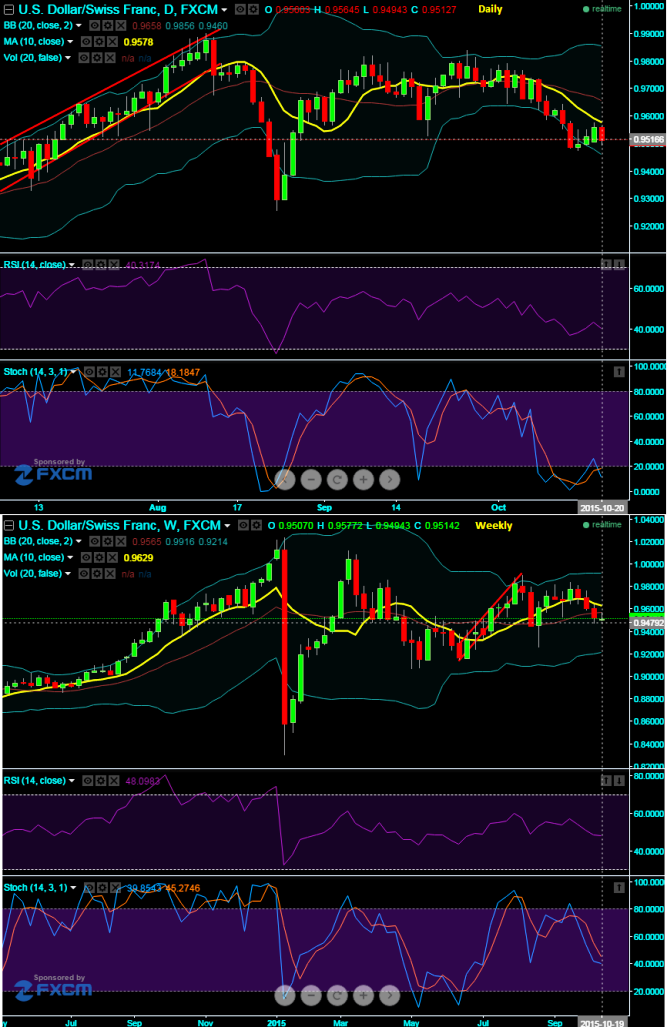

It has been a losing streak for dollar against Swiss franc about one and half months or so. The current prices on weekly chart have fallen below moving average curve, this would signal us that the prevailing bearish trend to prevail for some more weeks.

While RSI has been converging these price slumps, the current RSI on weekly chart is trending at 48.0405.

To confirm this bearish view, %D crossover on slow stochastic curves has maintaining above 75 levels which is again signals us selling pressures are intensified. On daily charts, even though these curves have bottomed below oversold zone, there no clues of %K crossover. So on daily terms bears have been well leading the show.

FxWirePro: Healthy Swiss trade balance to prop up currency – USD/CHF to extend dips

Tuesday, October 20, 2015 12:16 PM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings