Every time EURUSD dropped from 1.1461, subsequent bearish effects would be minimum of 3.29% or 350-400 pips southwards. The current price rejection has occurred at the same juncture in this pair.

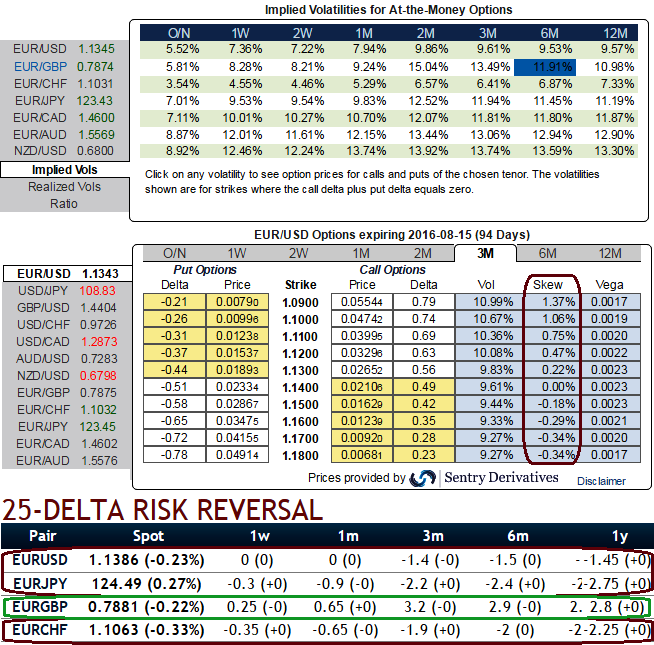

Looking for cheaper proxies Brexit would not only hurt the UK but also its European partners and as a result euro crosses (you could get to see that in risk reversal nutshell, especially for next 3M timeframe OTC reveals the hedging arrangements for downside risks in euro crosses except EURGBP), and the shock would likely pressure EUR/USD towards the bottom of its range and a 1.05 low again.

Ever since it has touched the lows of 1.05, the pair has been bounced from last 6 months or so and sensing resistance at 1.1461 offering second opportunity for those who haven’t hedged.

The 5 vol spread between cable and EUR/USD 3m volatilities is exaggerated in our view, making the latter a cheaper proxy for investors still looking for hedging solutions.

Taking advantage of richer EUR/USD skew EUR/USD 3m ATM vol remains under pressure after the ECB meeting, while the risk reversal is reaching its most negative level since last summer.

The skew appears rich compared to the volatility, strongly suggesting put spread-like structures.

The 3m tenor includes the 23 June vote and makes this maturity a natural selection for the hedge. A euro downside optional strategy will remain exposed for about one month after the outcome, giving the market extra time to digest developments.

Hedging Mechanics:

While hedging this pair, one needs to understand it is not only euro that needs to be taken care.

But, the dollar’s decline is also quite significant, and with EUR/USD close to the high end of its range.

The odds are currently favouring new euro shorts regardless of developments in the UK.

The skew is even more pronounced for lower strikes if you see for 12M tenors, so we get additional leverage in selling a put strike 1.04 or below.

Buy EUR/USD 3m put ladder with strikes set at 1.09/1.07/1.05 Indicative offer: 0.07% (spot ref: 1.1343).

A move below parity appears excessive given that the market is already well positioned for Brexit risk and that bullish dollar drivers have lost momentum (the Fed stepping back).

The solution optimizing the hedge leverage in a crisis scenario is an OTM put spread with a tight spread between the low and high strikes.

Our put ladder structure offers a constant payoff between 1.07 and 1.05 with greater leverage.

In comparison, a 3m one touch option with a 1.05 barrier costs about 20% and offers leverage of only 5x.

Risks Unlimited below 1.05 in three months Investors buying a EUR/USD 3m put spread strikes 1.09/1.07 financed by a put strike 1.05 face unlimited downside risks if the cross trades below 1.05 at expiry.