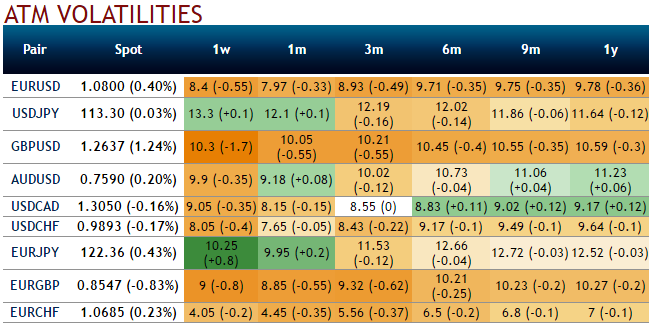

The UK would pursue a different future outside Europe, but the removal of uncertainty around the British stance should prove bearish for GBP volatility. Please be noted that the IVs of GBPUSD has been reducing despite series data, such as the UK PMIs, BoE monetary policy.

The early reaction of cash and option markets of GBPUSD has followed the line of reasoning, but it is not obvious to us that such a unilateral declaration of intent, however, bold and unambiguous, renders the actual Article 50 negotiations any easier to conduct.

GBP put/USD call digitals: GBP put/USD call digital prices, while not at absolute post-Brexit lows, are less expensive than at many points over the past year (refer above chart).

For instance, 5% OTMS cable put digitals offer maximum gearing of nearly 5 times, in the upper-end of the historical range of the past year since the Brexit referendum entered the market's consciousness as a risk event to reckon with.

9M -1Y 1.15 strike GBP put/USD call at-expiry digitals for instance cost in the vicinity of 16%-17% (mid, spot ref. 1.2668), which is a shade below the realized frequency of annual 5% -10% GBP spot declines over the past 20-years.

The inference is that there is little risk premium in option prices for the possibility of a material drop in sterling that could materialize in the event of a disorderly Brexit; at the very least, anxiety about such an eventuality is nowhere near post-referendum highs and not particularly elevated relative to historical spot outcomes. Digital options also offer a friendly decay profile and are suitable to hold through a long drawn Article 50 process that will play out over a period of months.

The May government has downplayed the notion of a transitional deal so far and remains optimistic that both the terms of withdrawal and a new trade deal can be concluded concurrently within the two-year timeframe set out by the Article 50 process.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed