- Gold prices has declined sharply and hits 5- 1/2 month low on Friday on account of strong USD. US dollar index was trading higher as central bank ECB is planning to keep its rates on hold till summer 2019 and euro plunged to 2- week low.The slight divergence in Fed and ECB is dragging Euro lower. US 2 –year bond yield was trading slightly lower after hitting highest level since 2008 and 10 year yield declined slightly after hitting 3%. USDJPY jumped almost 100 pips from low of 109.91. It is currently trading around 110.44. The yellow metal hits low of $1275 yesterday and is currently trading around $1280.

- The major three factors to be watched for gold price movement are

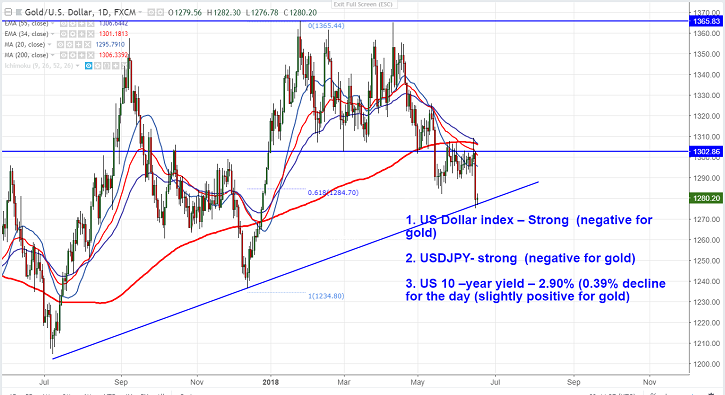

- US Dollar index – Strong (negative for gold)

- USDJPY- strong (negative for gold)

- US 10 –year yield – 2.91 % (0.40% decline for the day (slightly positive for gold)

- The yellow metals near term resistance at $1307 (200- day MA) and any convincing close above will take the yellow metal till $1316 (55- day EMA)/ $1324 (50% fibo).The minor resistance is around $1296 (20- day MA).

- On the lower side, near term support is around $1280 and any break below will drag the yellow metal down till $1275/$12698.

It is good to sell on rallies around $1290-92 with SL around $1300 for the TP of $1279/$1275.