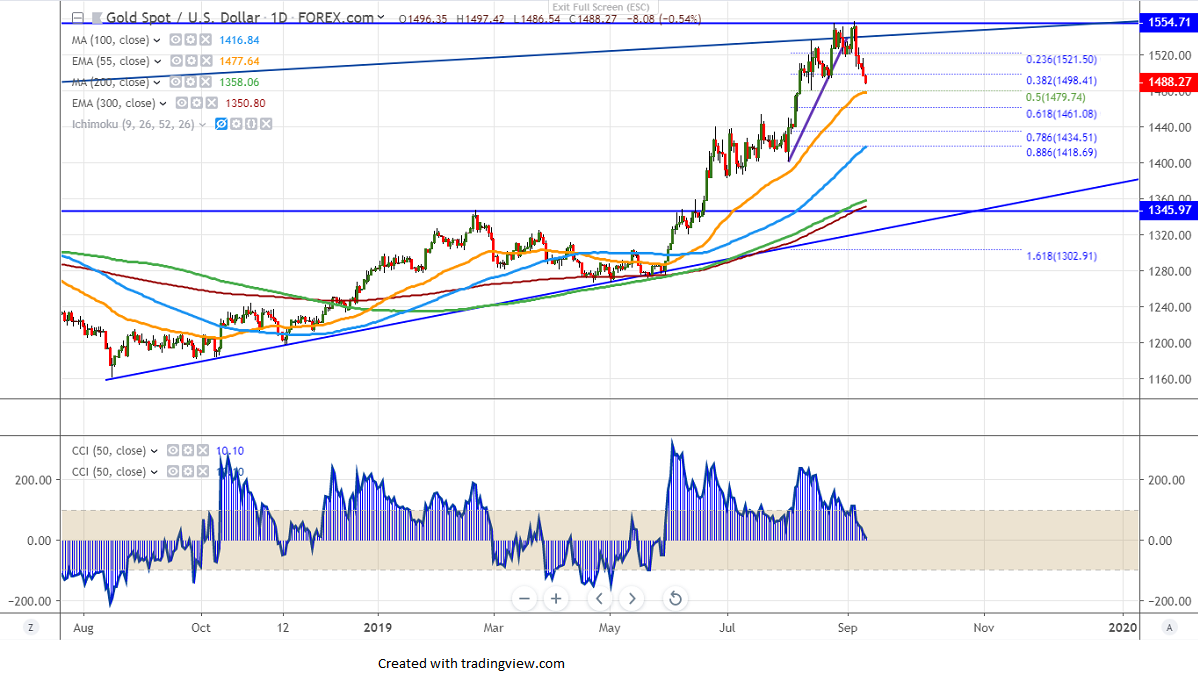

Major support- $1480

Gold is trading weak for the 5th consecutive day and lost more than $70 on rising bond yield. US 10 year bond yield shown a massive jump of more than 17% after hitting a 3-year low and is currently trading at 1.64%. The yield curve inversion between US 10 year and 2-year has gone, the spread narrowed to 4bps from 5 bps. Markets eye ECB monetary policy and press conference on Thursday. The central bank is expected to cut the deposit rate by 20 bps and any announcement of QE will have a positive impact on gold. It hits low of $1486 and is currently trading around $1489.02.

Technically, the pair is facing strong support at $1478 and any violation below confirms minor trend reversal, a dip till $1461/$1440 likely.

The near term resistance is around $1515 and any break above will take the yellow metal till $1527/$1540. Any major bullish continuation only above $1555.

It is good to sell on rallies around $1502-03 with SL around $1515 for the TP of $1461.