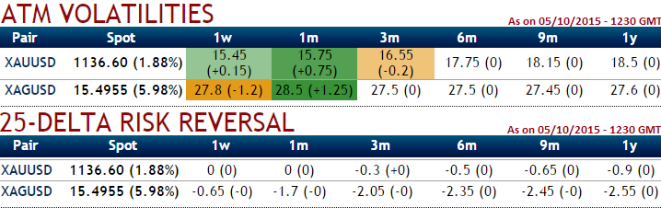

As per our prediction in our previous posts golds has gained from the lows of 1111.54 levels to the current 1137.54 levels. You can still observe the delta risk reversal has been neutral but shifted into red zone again for 3 months contracts with increased volatility from the above table. Further the positions constructed for bull overview will increase in value with time decay. But for now rate hike is almost deferred and what do you think can be the impact on gold?

Negative delta risk reversal numbers as shown in the nutshell suggests downside hedging in long term has been relatively expensive which means anticipation of gold prices to fall and although a short term price recoveries are likely on daily technical chart (max up to 1160) but makes us to have quite dubious eyes as there is now bearish signal generated by monthly moving average and trend analysis. RSI and slow stochastic are not substantiating daily upswings.

Option Strategic Framework: Diagonal option strips (XAU/USD)

Although Gold prices have been gradually rising from 1st week of August fanned optimism that the Federal Reserve's raising interest rates until the very end of 2015, lot of speculations on fed rate hike is going on in the markets which may have abrupt price distraction on either side.

Wait for the news to come out in order to take long term positions. Volatility will crush - you will get options at a cheaper price. But it may crush further. (And this is a big problem. However trading after news is better.)

Analyze the news. How bad or good is that. If the news is conducive then trade a Strap, otherwise trade Strip. If confused but still bearish, buy just OTM strike 2 puts and obviously that strike is just ITM for the call. You created a Strip highly favoring the bearish markets.

So, buy 15D At-The-Money delta call option and simultaneously buy 2 lots of 1M At-The-Money put options. As we anticipate this precious metal to rise in short to medium run but as a matter of hedging in long run, this strategy involves buying a number of ATM calls with shorter expiry and double the number of puts with long term expiry contemplating the fed's rate speculation on the table.

FxWirePro: Gold spikes as anticipated – improve odds on strips for hedging

Tuesday, October 6, 2015 8:33 AM UTC

Editor's Picks

- Market Data

Most Popular