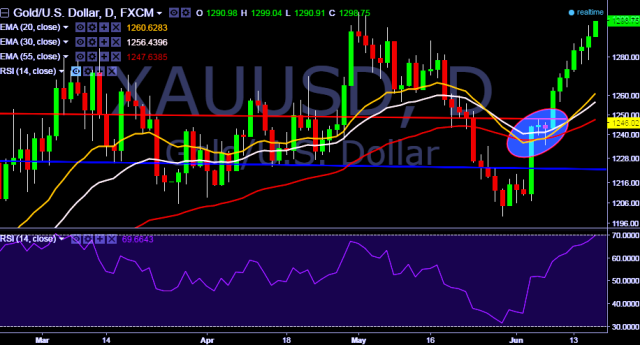

- XAU/USD is currently trading around $1297 marks.

- It made intraday high at $1297 and low at $1290 marks.

- Intraday bias remains bullish till the time pair holds key support at $1278 marks.

- A sustained close below $1278 will take the parity back below $1248 marks.

- Alternatively, a daily close above $1298 is required to drag the parity higher towards key resistances around $1303, $1316 and $1324 marks respectively.

- Key support levels are seen at $1285, $1282, $1278, $1272 and $1262 marks respectively.

- As expected, the Fed stands pat on monetary policy and kept the benchmark interest rate unchanged at 0.5%.

We prefer to take long position in XAU/USD only above $1,298, stop loss at 1,278 and target of $1,303/ $1,310/$1,316 marks respectively.