ECB cuts of deposit rates to negative 0.3% from minus 0.2% are cushioning a bit in gold prices, while the ECB left its key lending rate unchanged at 0.05%.

Bullion has lost nearly 7% of its value in November, its biggest monthly fall since June 2013, as investors remained focused on a possibly imminent rate hike in the United States.

The U.S. Federal Reserve holds its next policy meeting on Dec. 14th. A U.S. payrolls report on Friday (4th Dec'15) will be even more closely watched than usual.

Hedging Frameworks:

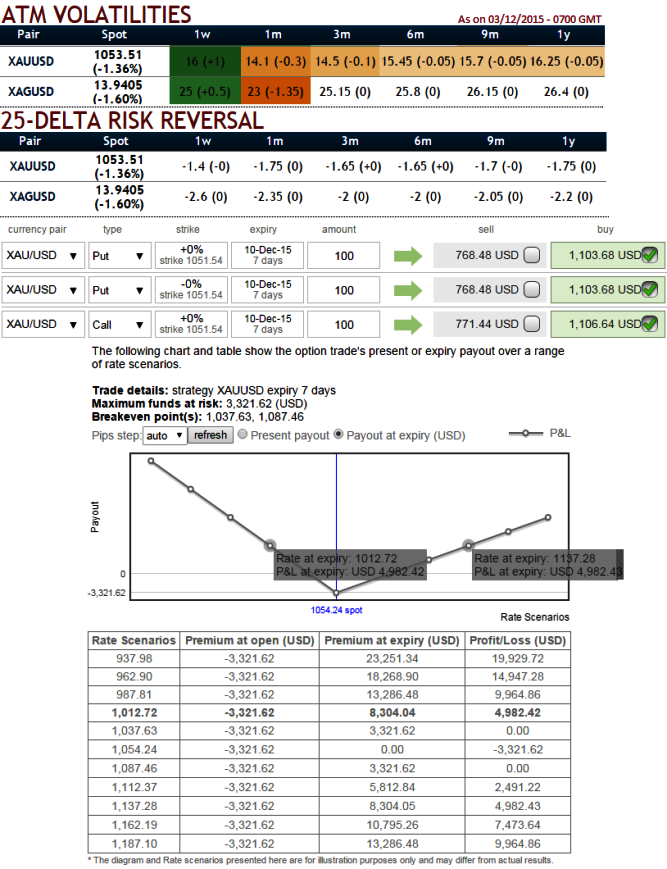

Despite the interim upswings after ECB's rate cut, bearish sentiments are boiling in the bullion market, glancing the IVs and risk reversals table makes us convinced bears have still been highly aggressive, we would like to get benefitted from downside momentum by implementing this strips strategy.

By buying 2 lots of 1W -0.49 delta puts and simultaneously 1 lot of 1W 0.50 delta calls of the same expiry would hedge the both abrupt rallies and anticipated dips.

Risk reward profile:

Risk is mitigated and limited to the extent of premium paid (US$ 3314) to the option writers.

Reward is unlimited until the expiry of the option (Payoff functions are shown in the diagram).

Please be noted that one can still mint money even if prediction goes wrong - but the price should spike in the adverse trend swiftly (i.e. ATM call bought that we buy has to beat the cost of buying all the options and still bring in some profits).

FxWirePro: Gold gains after ECB’s deposit rate cut - Stay hedged with options strips

Thursday, December 3, 2015 1:16 PM UTC

Editor's Picks

- Market Data

Most Popular

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate