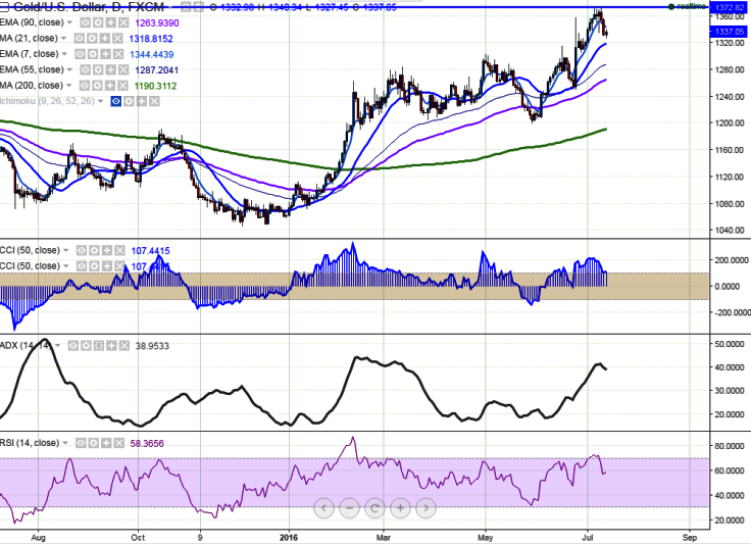

- Major Resistance - $1375

- Major support - $1316 (21 day MA)

- The yellow metal has broken major support $1335 (Jul 8th low) and declined till $1327.It is currently trading around $1337.

- Gold recovered from the low of $1327 and slightly jumped till $1340 at the time of writing. The yellow metal is still bullish as long as support $1316 (21 day MA) holds.

- The minor resistance is around $1347 (7 day EMA) and any further bullishness only above that level. Any indicative break above $1347 will take the gold to next level till $1354/$1363/$1375.

- The minor support is around $1325 and any violation below targets $1316/$1304 (daily Kijun-Sen).

It is good to buy on dips around $1330 with SL around $1315 for the TP of $1354/$1374.