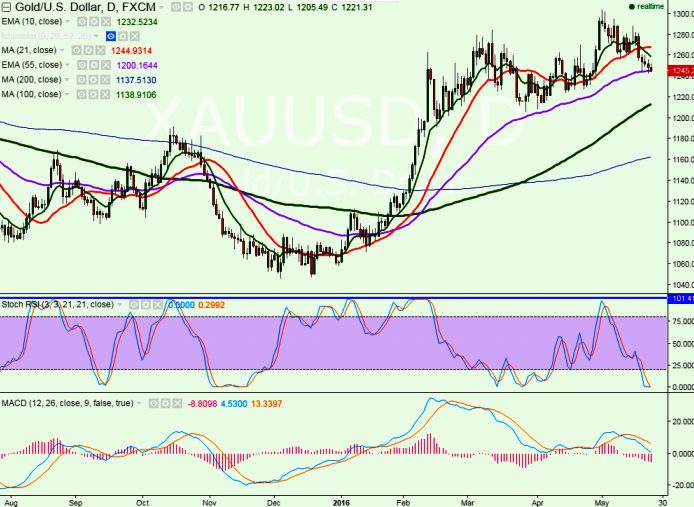

- Major support - $1243 (55 day EMA)

- Major resistance- $1268 (21 day MA)

- Gold has declined sharply yesterday on account of continuous chorus of Fed rate hike. It has declined till $1243 and closed at $1248. It is currently trading around $1245.

- Minor bullishness can be seen above $1260 level. Any break above $1260 will take the pair to next level at $1267 (21 day MA)/ $1275/$1283.

- On the lower side support is around $1243 and break below targets $1230/$1225.

- Overall weakness can be seen below $1200 level.

It is good to sell on rallies around $1250-$1252 with SL around $1261 for the TP of $1230/$1225