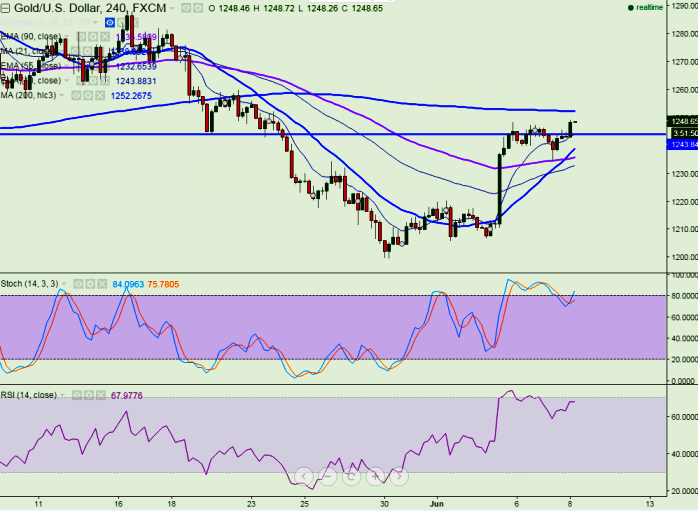

- Major Support - $1235 (90 day EMA)

- Gold has taken support near 90 day EMA and recovered from that level. It is currently trading around $1248.

- Short term trend is bullish as long as support $1225 holds.

- On the higher side any break above $1253 (200 day 4H MA) and any break above will take the bullion till $1264/$1270$1282

- Gold minor support is around $1235 and any break below targets $1228/$1225.

- Overall bullish invalidation only below $1200.

It is good to buy at dips around $1243 with SL around $1234 for the TP of $1260/$1272