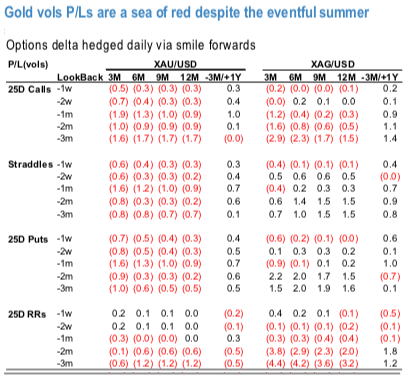

Despite an eventful summer and an almost 6% slide in gold price over the past three months, gold vols under-delivered across strikes and tenors (refer 1st chart). Historically, such price moves were worth 2-3 vol pts in 3M ATM vol. That makes last quarter’s gold underperformance especially notable. With vega leading the way, silver vols performed more in line with historicals (13% spot selloff vs. 0.7- 1.0vol of P/L from delta-hedged straddles). Bailed out by the underperformance of short tenor vols, vega-neutral, - 3M/+12M short gold gamma calendar spreads delivered modestly positive P/Ls over various lookback windows.

A closer look at the performance of gold gamma and risk reversals around tariff announcements is shown in 2nd chart. Except for the notable move post-March 22nd (+1.1vols and +1.5vols for vols and riskies respectively), on average vols and risk reversals were mostly muted in the aftermath of the announcements.

This however masks the higher frequency dynamic of short lived vol spikes (as large as 1.3-2.2vols). Obviously, timing was everything in 3Q as buy and hold got decimated by swift vol reversals (as clearly evident from 1st chart). Gold vols decoupled from alternative eserve currency FX peers (JPY, EUR and CHF) with 6M XAU-safe haven FX correlations back to near YTD lows even though JPY, EUR and CHF vols have broadly fared similarly poorly.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 12 levels (which is bullish), while hourly USD spot index was at 35 (mildly bullish) while articulating (at 11:12 GMT). For more details on the index, please refer below weblink:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis