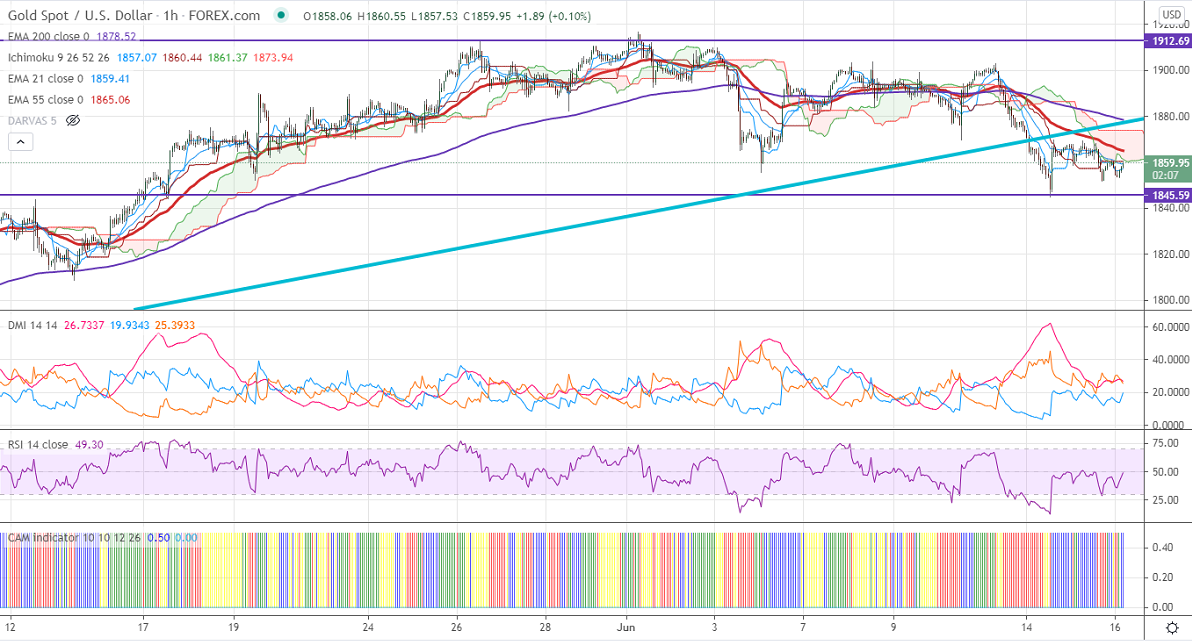

Ichimoku analysis (4-hour chart)

Tenken-Sen- $1865

Kijun-Sen- $1873.50

Gold is consolidating after hitting a low of $1844. Markets eye Fed monetary policy for further direction. The US retail sales dropped by 1.3% in May while core retail sales excluding auto, gasoline, building material declined by -0.7%. The US Producer Price Index surged to 0.8% in May slightly higher than consensus. The central banks expected to keep interest rates unchanged and a new dot plot to show a rate hike in 2023. The US bond yield is recovering more than 6% from minor bottom 1.428%. Gold hits an intraday high of $1866 and is currently trading around $1859.92.

Technical:

It is facing strong support at $1845, violation below targets $1835/$1820/$1790.Significant trend continuation only below $1675. On the higher side, near-term resistance is around $1873, any convincing break above will take the yellow metal to $1882/$1903/$1916 is possible.

It is good to sell on rallies around $1875-76 with SL around $1900 for the TP of $1802.