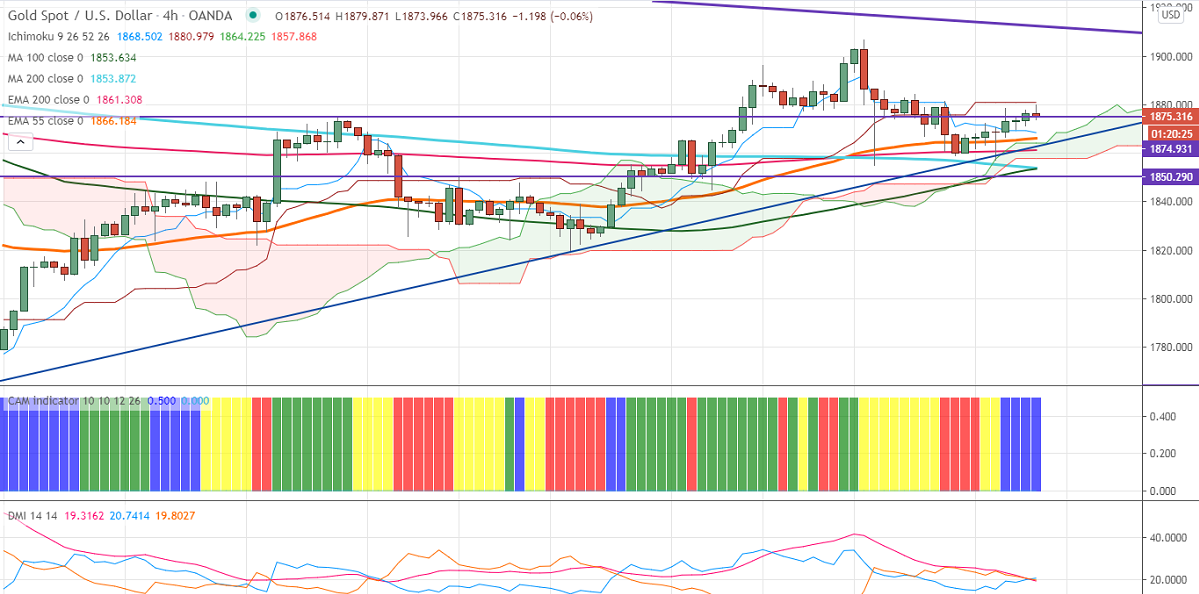

Ichimoku analysis (4-Hour chart)

Tenken-Sen- $1869

Kijun-Sen- $1880

Gold continues to trade higher and jumped more than $20 on US dollar weakness. The upbeat market sentiment due to US stimulus hopes and Brexit optimism is dragging the dollar index. But the spread of new stain of coronavirus in the UK and South Africa might demand safe-haven assets like gold. DXY upside capped by 21- day MA, any violation below 90 confirms bearishness. The US 10-year yield lost more than 3% from an intermediate top 0.971%.

Economic data:

US Final GDP QoQ rebounded at a 33.4% annualized rate compared to an estimate of 33%. The conference board consumer confidence came at 88.6 vs forecast of 97.1. Markets expect to trade quiet on Christmas eve.

Technical:

It is facing strong resistance at $1906, minor bullishness only above that level. Surge beyond targets $1925/$1938/$1950.On the lower side, near term support is around $1868, any indicative break below that level will take till $1864/$1855.

It is good to buy on dips around $1865-66 with SL around $1855 for the TP of $1900.