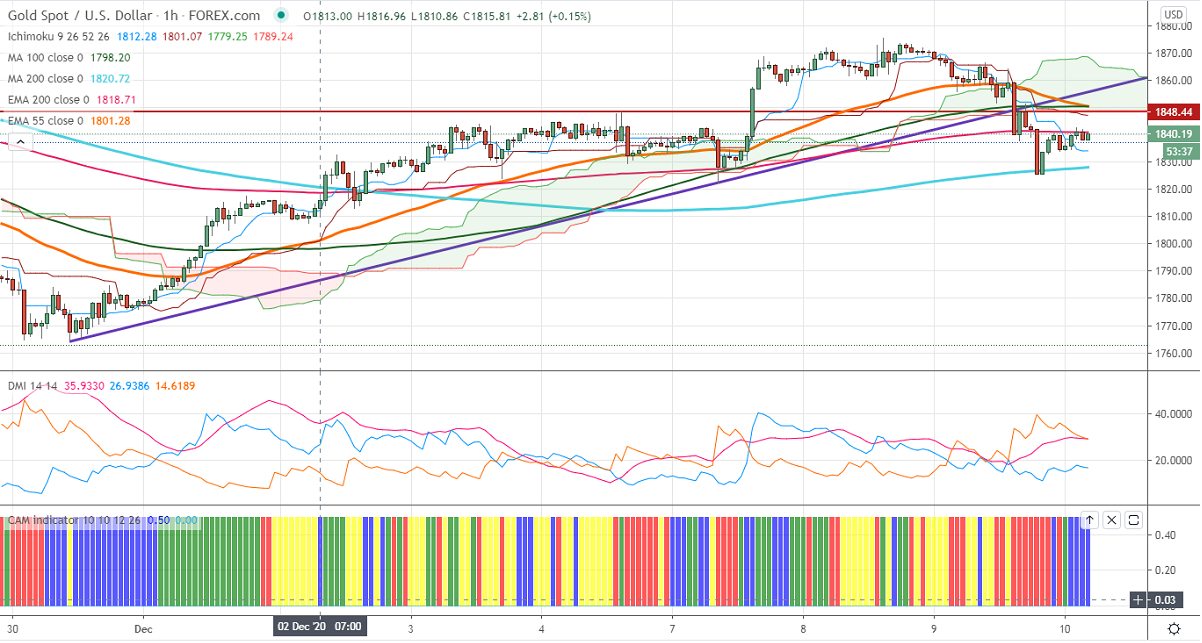

Ichimoku analysis (1- Hour chart)

Tenken-Sen- $1834

Kijun-Sen- $1847

Gold is trading weak after hitting a high of $1870 level on a strong dollar. The slight deterioration in risk sentiment is supporting the US dollar index at lower levels. DXY surged and jumped above 91 levels. Any violation above 91.50 confirms a bearish reversal. The US 10-year yield jumped more than 6% yesterday on stimulus optimism.

Economic data:

With no major economic data today markets eye ECB policy and US CPI data for further direction.

Technical:

In the hourly chart, Gold took support near 200- MA and any violation below $1825 will take the pair till $1800/$1765. On the higher side, near term resistance is around $1850, any indicative break above targets $1865/$1875/$1900.

It is good to buy on dips at around $1838 with SL around $1822 for the TP of $1900.