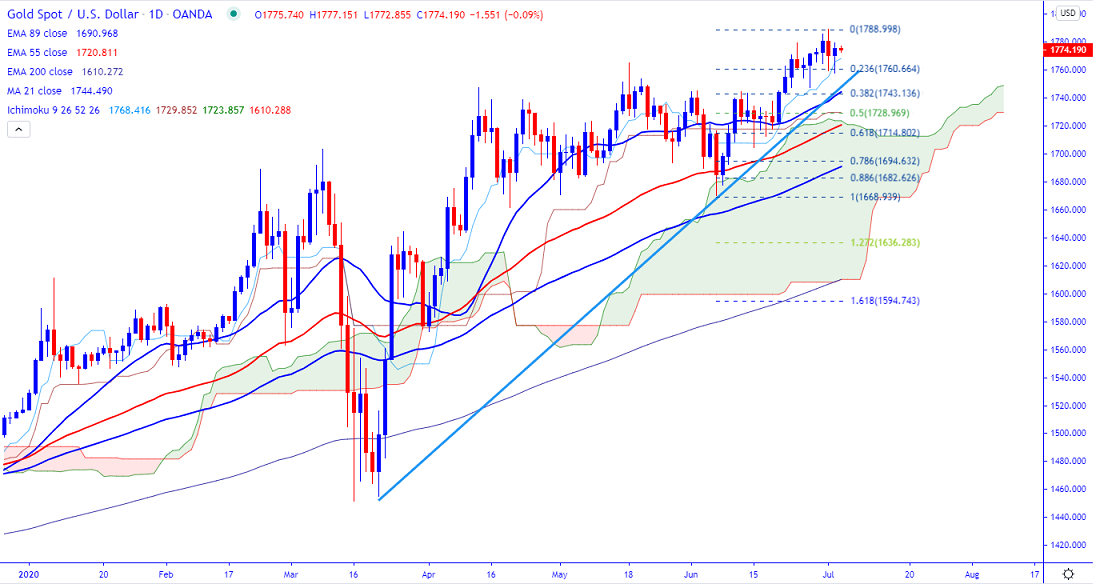

Ichimoku Analysis (Daily Chart)

Tenken-Sen- $1765.90

Kijun-Sen- $1725

Gold declined more than $40 after hitting a 7-year high $1789. The slight strength in the US dollar and positive economic data is putting pressure on the yellow metal. The U.S economy has added 4.8 million jobs in June compared to a forecast of 3.3 million and the unemployment rate declined to 11.1% to 12.4%. DXY jumped sharply after the data until 97.33. It is currently trading around $1774.

US Dollar Index – Flat (neutral for yellow metal)

S&P500- bullish (Positive for gold)

US Bond yield- Slightly positive (bearish for gold)

Technical:

The yellow metal is facing significant resistance at $1800, any violation above confirms bullish continuation. A jump till $1825/$1850 likely

The immediate support is around $1760 (23.6% fib), any indicative break beneath targets $1747/$1741 (21- day MA).

It is good to buy on dips at around $1760 with SL around $1747 for the TP at $1800/$1825.