A set of factors are influencing decision taking, liquidity and therefore market dynamics around the turn of the year.

- Cyclical hedges with yearly regularity may be reset at this time.

- Shareholders, investment managers taking their show fix at year end are not urged to take new risks that could endanger the profits cumulated over several months.

- It is a popular belief that equity markets are outperforming around the turn of the year (the 'January effect'), though it could be explained from a tax perspective.

- Fiscal and regulation requirements and Balance sheets are framed by the civil calendar. Various payments also occur at the year end.

- Holidays around the Christmas and New Year celebrations dampen global activity and market liquidity. Regarding volatility in particular, holidays remove days of variance.

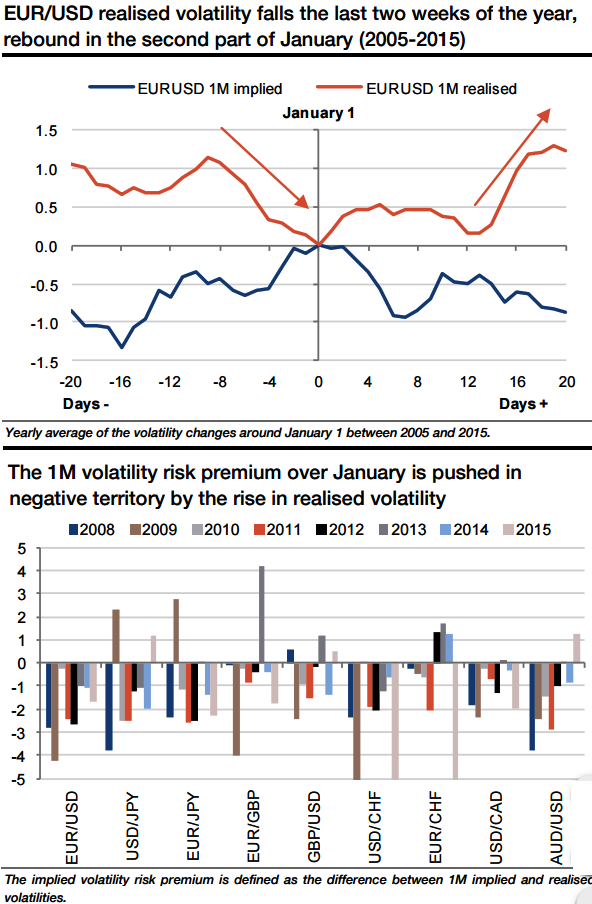

FX realized volatility in major currencies follows a general pattern: It falls the last two weeks of the year and bounces only in the H2 of January.

The seasonality in realized volatility is definitely stronger than in the implied volatility priced by the option market. But the net effect is that the volatility risk premium widens in the second half of December and turns negative in January.

Short gamma exposure is profitable during the last two weeks of the year and gamma performs again only in the second half of January.

So, add longs in 2M EUR/USD volatility swap, Go Short 1M volatility swap Indicative offer: 0.4 vols

The calendar spread of volatility swaps is essentially exposed to the realized volatility after the expiry of the short leg.

The trade will support losses if volatility fails to bounce in one month. Turbulence after the FOMC meeting is already discounted in the front-end of the curve, but a lasting volatility spike would also be hurtful.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary