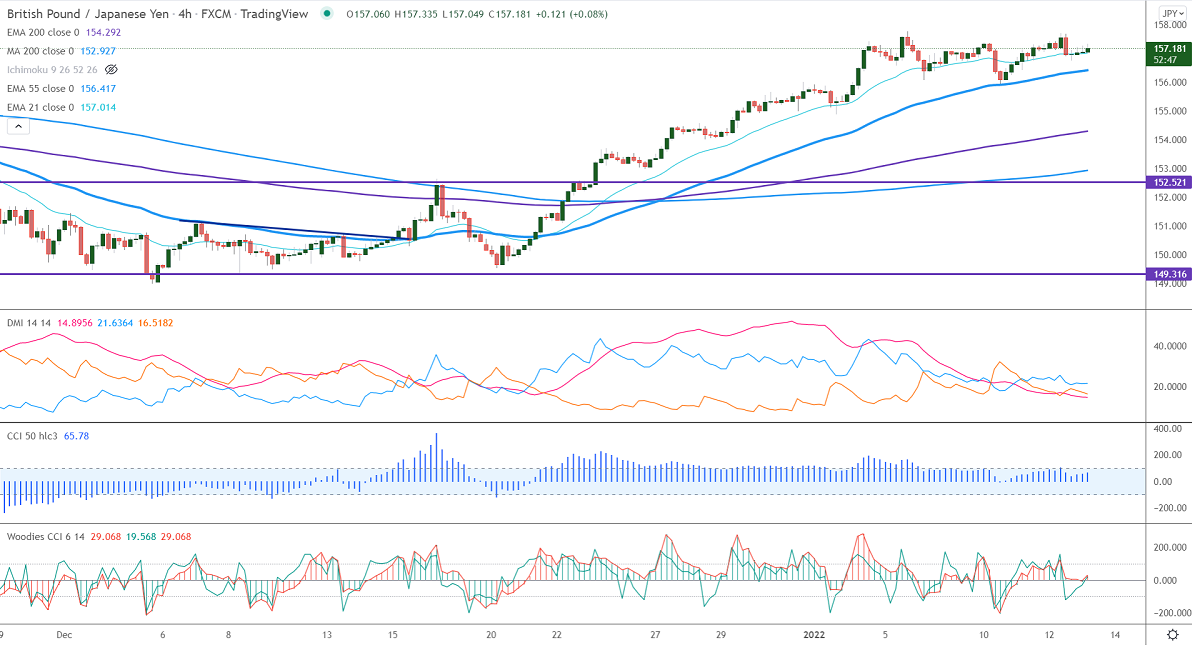

Short-term resistance -157.75

Intraday Support- 155.70

GBPJPY is trading flat despite strong Pound sterling. The cable gained sharply for a third consecutive week on board-based US dollar selling. The Brexit uncertainty and surge in coronavirus cases in UK weighing on GBP. Any breach above 1.3750 confirms further bullishness. The UK has reported another 120821 daily cases lower compared to the previous day case 141472. The intraday trend of GBPJPY is bullish as long as support 155.70 holds. GBPJPY hits a high of 157.70 at the time of writing and is currently trading around 156.80.

USDJPY- Analysis

The pair showed a profit booking after US CPI data. The intraday bearishness only if it breaks 114.

CCI Analysis-

The CCI (50) holds above zero levels in the 4-hour chart and Woodies CCI below zero line. It confirms the neutral trend.

Technical:

The immediate resistance is around 157.75, any break above targets 158/158.50. Significant bullish continuation if it breaks 158.50. On the lower side, near-term support is at 155.70. Any indicative violation below targets 155.25/154.70/154.

Indicator (4-Hour chart)

Directional movement index –Neutral

It is good to sell on rallies around 157.35-40 with SL around 158 for a TP of 155.70.